StayKing results of September 2023

October 3, 2023

What happened in the markets in September and how did our portfolio management perform?

Market situation

At the end of last month, the markets were positively influenced by the news of Grayscale's victory over the U.S. Securities and Exchange Commission (SEC). However, the enthusiasm quickly faded in early October as the market processed the full extent of the news, gradually realizing that "bread won't be cheaper" or, in this case, "bitcoin won't get more expensive" so quickly.

On the other hand, in the first week of October, ARK Invest and VanEck managed to submit applications to the SEC for a U.S.-based spot Ethereum ETF. ARK's application was filed jointly with 21Shares. These applications are similar to those submitted earlier this year for bitcoin spot ETFs. It's worth noting that, using the approval of bitcoin futures ETFs as a precedent, the SEC might approve Ethereum futures ETFs before considering spot ETFs.

If you've been following the FTX case closely, you'll know that FTX was granted permission by a bankruptcy judge to begin liquidating its cryptocurrencies to repay creditors. The bankrupt exchange can sell up to $200 million USD in assets every week, pending creditor approval. FTX's major cryptocurrency holdings include SOL, BTC, and ETH. However, there doesn't seem to be a massive sell-off in sight yet because a significant portion of tokens and cryptocurrencies are locked and will be released gradually.

Another collapsed exchange, this time Mt. Gox, which suffered a hack back in 2014, has delayed the repayment of more than 140,000 BTC and other cryptocurrencies to creditors by a year, extending the deadline to October 2024.

Some players aren't waiting for the approval of a bitcoin spot ETF and are stocking up on bitcoin now. MicroStrategy, one of the largest bitcoin holders, purchased approximately $150 million USD worth of bitcoin, buying 5,445 bitcoins at an average price of around $27,053 USD. The purchases were made between August 1 and September 24. The company has even mentioned considering further purchases.

Lastly, the saga with the CRV token that we mentioned in our last article came to an end. Curve's founder closed out his debt positions on the Aave platform, causing the CRV token to rally by 17%. This episode demonstrates how fragile the altcoin market can be.

So, how did all of this impact the results of our capital management?

If you've been reading our results articles, you'll know that we closed nearly all spot positions at the end of August. The market structure that has prevailed over the last month can be described as a crab market. Bitcoin's price moved sideways and stayed exclusively in the range of $25,000 to $27,000 USD.

From a fundamental perspective, news about macroeconomic developments and the crypto world have been so mixed that we are currently awaiting further developments before accumulating spot positions.

Our current strategy for spot accumulation is such that if either a clearly rising trend is confirmed or, conversely, if there is a significant market decline, we are not currently buying cryptocurrencies. We don't mind buying cryptocurrencies a bit more expensively in the long run, but if there was a major market downturn (for example, due to issues with Binance), we don't want to be caught "with our pants down", so to speak.

Instead, we are focusing on trading derivatives, especially futures. Futures are contracts that allow traders to speculate on future price movements. These contracts are made at a certain price and at a certain date in the future. Traders speculate whether the price will be lower or higher than the specified value at a certain time.

Our futures trading has been consistently successful, and this month, we have generated all our profits from it. We have also increased capital allocation into futures trading to make the results more noticeable. However, there weren't many opportunities on the market, and the market was relatively calm, without many situations in which we could enter according to our strategies. Nevertheless, we managed to generate a profit of 9.42% on our futures capital.

So, how did it all turn out in the end?

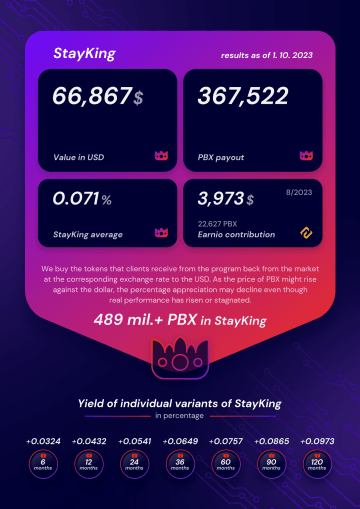

This month, we are distributing PBX among clients with a total value of $66,867 USD. We are distributing PBX at a slightly lower dollar value than last month, but because the price of PBX has increased significantly, a smaller amount of PBX is being distributed, which is also reflected in the lower percentage gain.

However, PBX holders shouldn't mind this, because with the rise in price, the dollar value of their portfolio is increasing.

If you have locked PBX in StayKing, for example, at a value of $0.045 USD, your average yield in dollar value is 4 times higher. The average yield this month is 0.071%.

PBX Delisting from ProBit Global: Key Dates and Important Instructions

The PBX token will be delisted from ProBit Global at the end of January 2026 as part of the exchange’s restructuring. We have arranged an extended timeline for trading and withdrawals to ensure a smooth transition. PBX remains fully supported and tradable on other platforms without any impact on tokenomics or utility.

November on the Crypto Markets: Crypto Market Crash & Liquidity Meltdown

November 2025 turned into a full-scale crypto collapse. Bitcoin and altcoins saw their steepest drop in years, ETFs posted record outflows, liquidity evaporated, and market sentiment plunged into extreme fear. Why was exiting the market the smartest move? And what does this reset mean for the months ahead? Read the full breakdown.

October on the Crypto Markets: Trump's tariffs triggered a record decline

October 2025 had it all – euphoria, panic, and survival. Bitcoin hit $126K before a record-breaking crash erased $400B in hours. Thanks to strict risk management, every open trade closed in profit. From Trump’s tariff shock to new altcoin ETFs and Fed rate cuts, the month reshaped the crypto landscape.