StayKing results of March 2024

April 5, 2024

Tomáš Hucík

The beginning of March was marked by anticipation in the cryptocurrency markets for a potential achievement of an all-time high (ATH) on Bitcoin. Although it seemed inevitable that the magical threshold of $69,000 per Bitcoin would be surpassed, it took a while. In the meantime, a frenzy started in the markets with meme coins.

Meme coins are cryptocurrencies, or rather tokens, that have no utility; their aim is simply to "materialize" some internet joke in cryptocurrency form. And there were a lot of them materializing in March. DOGE, SHIB, BONK, PEPE, and newer ones like WIF recorded astronomical gains. Some of the meme coins with lower market capitalization even saw gains in the hundreds of percent.

Many investors and analysts don't particularly appreciate this aspect of the cryptocurrency spectrum, considering it a degradation of investment efforts and analyses. However, I believe it's a nice expression of the original idea of crypto freedom, that everyone can do and create whatever they want. Let's not delude ourselves though. The high price of these meme coins is driven by nothing other than participants' desire for astronomical profits. Those typically come exceptionally rarely, and in the attempt to profit from meme coins, most retail traders get burned and lose money. This is because they serve as exit liquidity for insiders and influencers who received tokens for free at the beginning in exchange for promoting these dubious projects. Subsequently, these tokens are sold massively in the market, thus undercutting the price for unsuspecting retail traders.

The rocketing growth of the meme token Slerf, where its developer "supposedly" made a mistake and burned a portion of tokens, thereby reducing its circulating supply, propelled this meme token to lofty heights. But just as quickly as it skyrocketed, it's also beginning to decline. Source: dexscreener.com

In addition to popular meme coins, a new "type" of tokens has also emerged on the scene, called PoliFi.

These tokens often represent a politician or parody them. For example, MAGA token symbolizing Donald Trump, or BIDEN symbolizing the American President Biden. Parody tokens like Doland Tremp or Boden are then a kind of intersection between PoliFi tokens and meme tokens. According to some experts, PoliFi tokens are a good indicator of support for individual politicians, but it must be added that the driving force behind most participants in these markets is speculation rather than actual support. In other words, many market participants buy tokens mainly believing they can profit from them. Political affiliation is secondary.

For example, buying a MAGA token might be a kind of bet on the outcome of the US presidential elections. However, estimating how lucrative this bet could be is difficult. Perhaps instead of buying a token, it would have been easier to simply bet on the election outcome at a bookmaker's office.

In March, Bitcoin also reached its new All-Time High. In the middle of the month, it climbed to over $73,000 per bitcoin. The demand was primarily driven by sentiment and purchases from ETF funds on spot bitcoin, especially the IBIT ETF fund from BlackRock, which was exceptionally traded in March, and the trading volumes of this asset really exceeded all expectations.

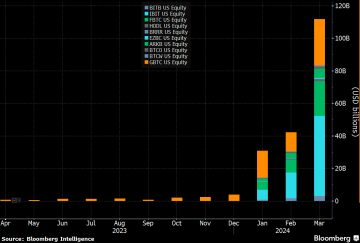

Bitcoin ETFs conducted transactions worth $111 billion in March, nearly triple the amount traded in February and January. Source: Bloomberg Intelligence

The price of Bitcoin in March fluctuated significantly, ranging from nearly $60,000 USD to a record value of $73,000 USD. However, at the beginning of April, it started to hesitate a bit.

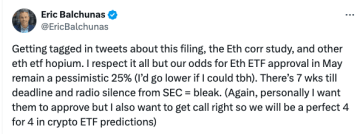

The price development of Ethereum, the second-largest cryptocurrency, is in a worse situation. ETH reached a price of $4,000 USD in March, but then it began to steeply decline. This is primarily due to the negative outlook on the possible approval of ETFs on spot Ethereum. The first approval deadline is in May, by which time the U.S. Securities and Exchange Commission (SEC) must comment on it. According to Bloomberg analyst Erich Balchunas, the chances of ETF approval at this stage seem low, currently giving it only a 25% chance. Balchunas points out that there are no visible steps from either the SEC or the applicants, unlike what was seen in the approval process for Bitcoin ETFs.

According to Eric Balchunas, the likelihood of approval for ETFs on spot Ethereum is even below 25%. Source: Twitter/X Eric Balchunas

March was even more volatile for altcoins. Some experienced significant growth followed by a sharp decline, such as Arbitrum. Such a volatile market requires patience and strict adherence to risk management.

How did our Probinex portfolio fare during this turbulent period?

If you've been following my previous articles closely, you know that we gradually increased the allocation for DEFI and Altcoin parts of our portfolio. This is the part dedicated to Altcoins, decentralized finance, and cryptocurrencies with lower market capitalization (smaller cryptocurrencies). Because these are smaller cryptocurrency projects with greater potential for growth, they were the most affected by volatility, and their prices began to decline, especially in the second half of March. In such a case, the portfolio manager is faced with a decision of whether to continue holding cryptocurrencies and try to "ride out" the decline or to sell them with the intention of buying them back at a lower price in case of a further decline. After thorough analysis, we opted for the latter option, and it proved to be the right decision. Prices dropped even lower, allowing us to buy into our DEFI portfolio at even lower price levels.

We managed to maximize our gains from this situation. If you're curious about what this part of the portfolio contains, besides various Layer 1 blockchains, it also includes tokens from the area of RWA (real-world assets, cryptocurrencies representing assets from the physical world such as real estate, commodities, or bonds), or from the now very popular field of artificial intelligence.

We didn't make any changes to our spot strategies. In the end, there's no reason to change something that works. We still hold the purchased bitcoins, and as Bitcoin reached a new ATH, we were able to gradually move the Stop Loss protective order higher. Thanks to this, we already know that this position will end in profit; it now depends on how high Bitcoin will go.

In StayKing, we distribute 138,964 PBX worth $22,870 this month, with an average StayKing yield of 0.027%.