Happened in crypto: Dow Jones is officially more volatile than Bitcoin. Breakthrough in adoption?

October 12, 2022

Jiří Makovský

The Dow Jones Industrial Average (DJIA) is an index of the 30 largest and most traded US stock companies. It is considered a clear indicator of the performance of American industry and services. The mostly stable DJIA is having a wild year.

The cryptocurrency market is well-known for its high volatility as the prices of individual assets fluctuate enormously. The American stock market is experiencing the very same thing this year — Dow Jones' volatility is now officially higher than Bitcoin's, which is completely unheard of. What will be the impact on institutional investors?

You can find out the answer & much more from the world of cryptocurrencies in our article!

The bankrupt Celsius platform leaked the names and transactions of TENS OF THOUSANDS of clients

Celsius is facing court proceedings over its bankruptcy, which has seen most of its clients lose money. The service folded after too many people started withdrawing their cryptocurrencies from their wallets as the platform could not procure the liquidity to pay everyone. The falldown was sealed by due investment loans, therefore the company quickly went belly-up and announced bankruptcy.

Lawsuits from investors quickly followed. Court documents now reveal spicy details that Celsius even released the names, wallets and transaction history of tens of thousands of people as a part of its defense. The entire list is 14,500 pages long and the community was indeed shocked, since such treatment of personal data, especially in the crypto industry is truly outrageous and to many even unforgivable. Celsius is apparently done & gone for good.

Last time we wrote: Happened in Crypto: Is Bitcoin’s Worst Over?

$566 million stolen in Binance Smart Chain hack

One of the biggest hacks in blockchain history has taken place. The attack used loopholes in the code of the BSC Token Hub application, which ensures the secure connection between different chains - these are the so-called "bridges". Due to the attack, $586 million in cryptocurrencies disappeared. However, the fraudster(s) escaped with "only" $110 million.

The attack itself was planned very well. While the bounty was being snatched, the application continued to run. It was only shut down later when several members of the community pointed out suspicious behaviour. Binance brought down the entire network, though the price of BNB remains untouched despite the incident.

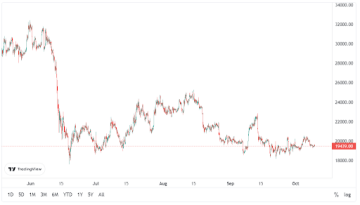

BNB/USDT price within the last five days. Source: TradingView

Services serving as bridges between blockchains are proving to be an easy target. In fact, 69% of stolen funds from all hacks on the market come from errors in the code of these applications. It is already over $2 billion.

The Dow Jones Industrial Average fluctuates in price more than Bitcoin

The DJIA is the second oldest index in the US market. It has been formed to showcase the best of Wall Street and create a perfectly stable asset that reflects the economy. However, the post-COVID crisis on the other side of the Atlantic has left a strong mark even on Dow Jones itself with its figures being unprecedently volatile.

In contrast, BTC has not left the $20,000 price tag for weeks. The low volatility against the index shows that the largest cryptocurrency has truly matured as an investment. This manifests itself that such swin gs will be reduced due to high liquidity. This is great news for investors. Another call for financial institutions to no longer worry about unusually large fluctuations.

As always it is not quite certain where the cryptocurrency is about to head next. Each of these adventures sooner or later returns the coin's value to $20,000. Lately, it is talked within crypto circles about the bear market being over.. Well, let’s see about that!

That's it for this issue! Join the Probinex Telegram and discuss the news with us!