August on the Crypto Markets: Bitcoin at max and ETH shining

September 5, 2025

Tomáš Hucík

What about our porfolio?

In our own portfolio, we continued holding our long‑term spot positions in Bitcoin, Ethereum, and a focused selection of fundamentally strong altcoins. The early August breakout pushed all of these holdings into open profit, including those that had previously been slightly under water. This shift clearly reflects the broad‑based strength of the crypto market – particularly the strong institutional momentum behind the majors, and a renewed appetite for high‑quality altcoins.

Thanks to this growth, our exposure to the market has increased naturally to over 93%, without initiating any new trades. The appreciation of our existing positions has meaningfully reduced the share of capital held in stablecoins. Importantly, we have not taken profits yet – the portfolio’s equity growth in August is entirely unrealized at this point. Nevertheless, we’ve taken protective measures and moved stop‑loss levels higher across the board, especially for altcoins. This ensures that even if a more pronounced correction occurs, we will exit many of these positions at a gain, preserving profits and protecting capital.

In line with our long-term strategy, we did not close any positions in August and refrained from active short-term trading or opening any leveraged futures positions. – This month, PBX tokens contributed by July's Earnio will be distributed through StayKing.

Thanks to the nice result of July's Earnio, we are distributing 1,327,514 PBX worth 38,534.4 USDC.

This is in line with our risk-focused approach and our commitment to distribute only actual realized profits from currently closed positions.

Summary of developments in August 2025

The month started off strong. Bitcoin broke through the $120,000 barrier, eventually reaching a new all‑time high near $124,500. This move validated the July breakout above $108K, confirming that the late‑summer rally was driven by true demand and not just technical momentum. The rally was supported by speculation around Fed rate cuts, a weakening dollar, and generally bullish sentiment across risk assets.

Source: tradingview.com

After topping out mid‑month, Bitcoin corrected back toward the $108,000–$110,000 zone, where it has since stabilized. This suggests that former resistance has indeed flipped into support – a healthy sign in trending markets. The area around $125K has now become the key resistance to watch, while $100K remains the strong psychological support. So far, bulls have successfully defended higher levels without testing that lower zone again. Our position is currently in profit and we are managing it carefully.

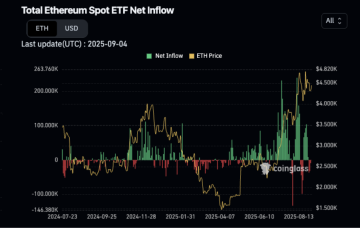

Ethereum was the standout performer. ETH gained around 18% over the month, reaching $4,950 at the peak – just below its historical high. The key driver here was a surge in inflows into Ether spot ETFs, which collectively saw record‑breaking monthly inflows exceeding $3.8 billion. This institutional momentum boosted ETH’s price and supported a stronger performance than Bitcoin. Our ETH position is now well into profit and continues to be one of the top‑weighted altcoin holdings in the portfolio.

Among our altcoins, Solana (SOL) finally broke out of its multi‑month stagnation and rallied strongly in the first half of the month. It briefly traded above $200, moving our position – which had previously been in a loss – into a healthy profit. The rally followed a series of positive network developments and speculation about Solana’s inclusion in future institutional products.

Chainlink (LINK) was another key contributor to portfolio growth. The U.S. Department of Commerce announced plans to publish economic data directly onto public blockchains using oracle services – including Chainlink and Pyth. This news triggered a sharp rally, with LINK gaining nearly 60% over the month and returning to positive territory in our holdings. As LINK plays a crucial infrastructure role in DeFi and real‑world asset tokenization, its revaluation feels well‑deserved.

Overall, the altcoin segment of our portfolio benefited significantly from these developments. Even though the broader altcoin market remains selective, several of our positions were aligned with sectors and narratives that attracted institutional or regulatory interest. Our patient approach to holding altcoins with clear utility and strong fundamentals has so far proven effective.

What to expect next

September is typically a weaker month for crypto, historically posting negative returns more often than not. That said, past performance is not destiny – and after August’s pullback, the market is approaching September from a more balanced position. We expect one of three scenarios:

Breakout above $125K: A clear move through this resistance could trigger renewed FOMO and another leg of price discovery. In that case, we’ll remain fully positioned to benefit, having never reduced exposure.

Sideways consolidation between $110K and $125K: A high‑range consolidation would be a healthy pause before another advance. This would allow the market to digest gains, especially in altcoins.

Deeper correction toward $100K–$105K: A macro surprise or sharp liquidation event could still send Bitcoin lower, but even in this case, we have strong protection in place. Our stop‑loss levels for altcoins are all set above entry, meaning we’ll preserve capital and lock in partial profits even in this scenario.

On the macro side, expectations of a Fed pivot in Q4 and ongoing institutional adoption of crypto ETFs continue to provide tailwinds. Our portfolio is well positioned for any of these scenarios. We remain disciplined and fully invested in the cycle, and we’ll continue adjusting our positions with care if fundamentals or market structure shift in the coming weeks.

Our position

Macro forces set the tone in August. U.S. inflation data for July (released mid‑August) showed prices rising around 2.7% year‑over‑year, slightly slowing the disinflation trend and keeping pressure on policymakers. All eyes then turned to Fed Chair Jerome Powell’s speech at Jackson Hole on August 22. Powell struck a cautiously dovish tone, emphasizing a data‑dependent approach and not committing to any specific timeline for easing. Crucially, he did not shut down the possibility of rate cuts in the near future, which markets interpreted as a green light for risk assets. In fact, futures markets began pricing in high odds (over 80% probability) of a 25 bps rate cut as soon as September. This prospect of easier monetary policy buoyed market sentiment – a weaker dollar and lower rates tend to favor Bitcoin and other non‑inflationary assets.

However, the macro picture wasn’t all rosy. Early in the month, a tentative risk‑off episode emerged when new U.S. trade tariffs were floated by the White House, stirring trade war concerns.

Bitcoin (BTC) extended its bull run in August, surging to a fresh all‑time high above $124,000 on August 14. This milestone – breaking the previous peak around $111K set earlier in the year – underscored the market’s strong risk appetite. Analysts credited a mix of factors for the rally: expectations of Fed easing, continued institutional buying, and momentum from ETF optimism. By mid‑month, even as macro data put a ceiling on euphoria, Bitcoin remained comfortably in six‑figure territory.

But the king of crypto didn’t finish the month unscathed. In the final week of August, BTC prices slid from ~$120K toward $108K, a roughly 10% drop. The sharpest jolt came from within the market: a known whale moved 24,000 BTC (≈$2.7 billion) into an exchange, spurring fears of a sell‑off. This large transfer indeed triggered a flash crash, cascading into about $800–940 million of long position liquidations as prices briefly dipped to the low $108K range. Bitcoin swiftly stabilized after the purge – finding support just above the key ~$107K level – but the episode was a reminder of lingering volatility even in a maturing market. By August 31, Bitcoin hovered around $108–109K, roughly ‑7% for the month.

If Bitcoin’s rally was impressive, Ethereum (ETH) managed to steal the spotlight with its own record‑breaking move. The second‑largest crypto surged to nearly $5,000 – hitting about $4,950 on August 24 to mark a new all‑time high for ETH.

Source: coinglass.com

This represented a double‑digit percentage gain for the month and a remarkable comeback for Ethereum, which last flirted with these price levels back in late 2021. Unlike in that cycle, this time institutional demand played a pronounced role. ETH‑focused investment funds saw massive inflows in August, totaling roughly $3.9–4.0 billion. In fact, during the week of Ethereum’s breakout, single‑day inflows into U.S. Ether ETFs topped $300–450 million – a record pace. This wave of capital helped propel ETH higher and even strengthened the ETH/BTC ratio, indicating many investors rotated out of Bitcoin into Ether to capitalize on its momentum.

Other altcoin movements were tied to similar one‑off developments. Cronos (CRO) – the token of Crypto.com’s ecosystem – saw a speculative surge of over 30% (and at points much more intraday) on rumors of major partnerships, including one with a media venture linked to former President Trump. Solana (SOL), a top smart contract platform, managed a modest gain of about 1% to ~$205 by month’s end. Solana benefited from two drivers: first, news that Europe’s central bank is evaluating Solana’s blockchain for a possible digital euro, and second, continued technical enhancements (Solana’s developers rolled out improvements aiming for sub‑second finality, boosting investor optimism in its tech).

On the flip side, some major alts lagged. XRP, which had surged in July after a favorable U.S. court ruling, gave up about 0.35% in August to end around $3.01. The pullback came as the SEC delayed decisions on pending XRP spot ETF applications to later in the year, muting hopes of an immediate catalyst. Similarly, Dogecoin (DOGE) dropped as well as hype around a potential DOGE ETF or new use cases failed to materialize in the short term.

In summary, August was not a broad “alt season,” but those projects with concrete positive news – especially involving institutional adoption or technical milestones – enjoyed outsized gains, while others treaded water or corrected slightly.

Regulatory developments in August were a mixed bag but generally signaled a gradually maturing framework for crypto. In the United States, the focus remained on the expanding roster of crypto ETFs. Having already allowed Bitcoin and Ether ETFs (spot‑based) in late 2023 and 2024, the SEC found itself reviewing dozens of new ETF filings targeting various cryptocurrencies. By August, over 90 crypto ETF applications were in the pipeline – including funds for Solana, XRP, Cardano, and even Dogecoin. The agency, however, chose to extend the decision deadlines on many of these in August, pushing several verdicts to October 2025 or beyond. This wasn’t unexpected; regulators cited ongoing concerns around custody and market manipulation for these altcoin products.

Crypto’s march into the mainstream wasn’t confined to the private sector – governments worldwide made news by embracing blockchain tech in August. In Europe, officials offered perhaps the biggest surprise. According to an August 22 report in the Financial Times, the European Central Bank (ECB) is seriously considering building a digital euro on public blockchain networks like Ethereum or Solana. This marks a sharp turn from the assumption that any central bank digital currency would run on a closed, permissioned ledger. The openness to using Ethereum or Solana for a CBDC reflects the EU’s recognition of the security and maturity of these networks. While no final decision has been made (the ECB will decide by the end of 2025 on whether to proceed with a digital euro), the fact that public blockchain technology is on the table gave a boost to sentiment around those ecosystems.

Veškeré informace uvedené v tomto článku a jeho obsah nemá sloužit jako investiční poradenství, doporučení či závazný návod k finančnímu rozhodování. Společnost Probinex nenese odpovědnost za jakékoli rozhodnutí učiněné na základě těchto informací. Každý čtenář by si měl před jakýmkoli investičním krokem provést vlastní analýzu a případně konzultovat odborníka.