How Probinex and Tomáš predicted the future of cryptocurrencies: Evaluating 10 predictions for 2024

January 9, 2025

Tomáš Hucík

Exactly one year ago, I wrote a bold article with 10 predictions about the cryptocurrency world for 2024.

Let’s take a look together to see how well those forecasts turned out.

1. Halving in 2024 will not be as exciting as previous ones

The halving took place in spring 2024, reducing miners' rewards per block from 6.25 BTC to 3.125 BTC. Although this moment was expected to act as a potential catalyst for Bitcoin's price growth, the market reaction was rather moderate and very different compared to previous halvings.

Reason? The market is more mature, and information about the halving was known long in advance. While Bitcoin's price did increase from the beginning of 2024, the effect of the halving was gradually priced in before the actual event.

Tradingview.com. After some time post-halving, a parabolic growth period typically follows. However, the chart after the fourth halving looks different from the previous ones.

Verdict: I was correct

The halving indeed did not bring as much excitement as in the past. The Bitcoin market is more stable and less susceptible to sudden fluctuations caused by predictable events.

2. Spot Bitcoin ETFs caused significant capital inflows

In January 2024, the U.S. Securities and Exchange Commission (SEC) approved the first spot Bitcoin ETF, allowing institutional investors to access Bitcoin through regulated financial products.

Spot Bitcoin ETFs attracted tens of billions of dollars in capital in the first quarter of 2024, far exceeding my original estimate of $2–3 billion.

Verdict: 50:50

Bitcoin indeed caused significant capital inflows. I could consider this prediction correct, but my estimate was embarrassingly low. The capital inflow into spot Bitcoin ETFs in the first quarter of 2024 was much higher than I had expected. Therefore, a 50:50 evaluation seems fair.

3. MiCA will help those who want to do things right, but it will take time in the Czech Republic

The European MiCA regulation was adopted to create a unified regulatory framework for crypto-assets across the EU. In the Czech Republic, the Czech National Bank (CNB) is expected to be the main supervisory authority for crypto service providers.

A transitional period has been established for existing service providers, allowing them to continue operations under current conditions until July 1, 2026, unless a member state opts to shorten this period. The Czech Republic plans to use the full length of this transitional period.

Verdict: I was correct

The implementation of MiCA in the Czech Republic is relatively slow, matching my expectations. Gradual market adaptation, emphasis on the transitional period, and a conservative approach show that the Czech Republic chose a cautious pace, which may minimize errors but also delays access to the benefits that regulation provides.

4. Ethereum will have lower fees, causing a massive increase in transaction volume

In March 2024, Ethereum implemented EIP-4844, known as Proto-Danksharding, which introduced "blob" transactions. This innovation significantly reduced transaction fees on Layer 2 solutions, in some cases below $0.01, making DeFi applications and microtransactions more accessible.

The fee reduction led to a significant increase in Layer 2 activity, boosting Ethereum's overall transaction volume.

Verdict: I was correct

The implementation of EIP-4844 reduced Ethereum's transaction fees, resulting in a notable increase in transaction volume on Layer 2 solutions and supporting the growth of DeFi and microtransaction-based applications.

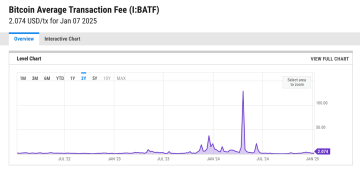

5. Bitcoin BRC-20 and NFTs on Bitcoin did not maintain high transaction fees

While the use of Bitcoin Ordinals and BRC-20 tokens caused an increase in transaction fees in early 2023, this trend began to fade in 2024. Interest in Ordinals and BRC-20 tokens dropped significantly as the initial hype subsided. By mid-2024, transaction volumes and fees related to these use cases had declined sharply, with only a temporary revival at the end of 2024.

The Bitcoin network saw transaction fees return to more typical levels as the block space was no longer heavily used for NFT or token-related transactions. This decrease in activity also meant that the anticipated shift in the Bitcoin ecosystem toward broader NFT or BRC-20 adoption did not materialize.

Source: https://ycharts.com/

Verdict: I was wrong

The trend of Ordinals and BRC-20 tokens faded in 2024 and did not sustain the high transaction fees I expected. Although these innovations briefly attracted attention to Bitcoin, they have not yet established themselves as long-term, relevant use cases.

6. Financial advisors begin recommending Bitcoin

My prediction that financial advisors would start recommending Bitcoin in 2024 turned out to be accurate. Several surveys and reports from 2024 confirm this growing trend.

In March 2024, a Digital Assets Council of Financial Professionals (DACFP) survey showed that 50% of advisors planned to recommend cryptocurrency investments to their clients within the next 12 months. By June 2024, DACFP reported that 40% of advisors had already recommended crypto to at least half of their clients, up from 32% in March

In August 2024, legendary investor Bill Miller predicted that financial advisors would start recommending a 1–3% allocation to Bitcoin within the next three to five years, reflecting growing acceptance of Bitcoin as a legitimate investment asset.

Additionally, by the end of the year, BlackRock mentioned that allocating up to 2% of capital into cryptocurrencies could help portfolios achieve better returns.

In the European Union, this trend might further accelerate due to MiCA regulation, which provides clearer rules for cryptocurrency investments and could increase trust among advisors and clients, supporting broader adoption in traditional investment strategies.

Verdict: I was correct

In 2024, financial advisors began recommending Bitcoin to their clients, reflecting growing acceptance of cryptocurrencies in traditional investment strategies.

7. Crypto will be in the green across many sectors

My prediction that crypto would grow across multiple areas in 2024 turned out to be correct, though in hindsight, more specific numbers or data would have been helpful.

Bitcoin saw significant growth, surpassing the $100,000 mark. Other cryptocurrencies, like Ethereum, XRP, and Solana, also rose substantially, pushing the total crypto market capitalization to a record $3.2 trillion.

The reduction in transaction fees, especially on networks like Ethereum, drove increased activity on decentralized exchanges (DEX), resulting in higher transaction volumes and greater involvement in DeFi platforms.

Coinbase delivered impressive financial results in 2024, with Q1 revenues reaching nearly $1.6 billion, more than double the same period in the previous year. This growth was partially fueled by higher trading volumes and its role as a custodian for crypto-backed ETFs.

Verdict: I was correct

In 2024, the cryptocurrency sector grew significantly across various areas. My prediction, though broad, aligned with the developments throughout the year.

8. Gamers won’t make it

The prediction that a mass-popular blockchain-based game would not emerge in 2024 was accurate. Despite the growing number of blockchain games, none achieved mass popularity comparable to traditional games.

Hamster Kombat: Although the game gained a notable user base on Telegram, its popularity was limited to specific communities and did not translate into broader success within the gaming industry.Even if it had succeeded, I wouldn’t have counted it. Hamster Kombat was essentially a boring clicker game with little to do with real gaming.

Overall, while blockchain games saw some growth and interest in 2024, none became mass-popular games that appealed to a wider audience beyond the crypto community.

Verdict: I was correct

In 2024, there was no creation of a mass-popular blockchain-based game, affirming my skepticism about the necessity of integrating crypto technologies into the gaming industry.

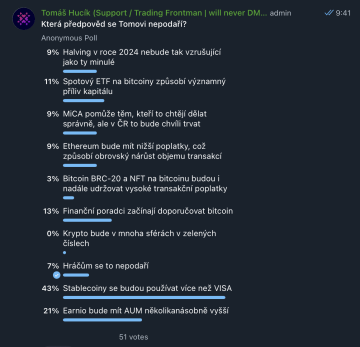

9. Stablecoins will be used more than VISA

This was undoubtedly my most controversial prediction, as reflected in a Telegram poll where it had the least support.

My estimate that stablecoins would surpass VISA in usage in 2024 proved to be partially accurate. Stablecoin transaction volumes reached around $27 trillion in 2024, more than double VISA’s transaction volume of approximately $13 trillion during the same period.

However, this is not the full picture. The $27 trillion figure represents total transactions, including operational transactions on exchanges, internal smart contract transactions, or artificial bot-driven transactions. Looking at adjusted data and real transactions with genuine commercial intent, the volume is "only" $5.67 trillion, which is less than VISA's volume.

Verdict: I was wrong

In 2024, stablecoins did not surpass VISA in the volume of real, processed transactions. While my numerical prediction was incorrect, the growing number of stablecoin transactions highlights their increasing importance.

10. Earnio will have several times higher AUM

I think this prediction turned out well. In December 2023, Earnio’s assets under management (AUM) were just over $4 million USDC. By December 2024, this figure had grown to $12.5 million USDC.

I consider this an excellent result, particularly due to the hard work of our sales team. Earnio now has a two-year verified history, and after obtaining a CASP license, it can fully spread its wings.

Verdict: I was correct

Earnio successfully tripled its AUM. Whether we can achieve this again remains to be seen in the predictions for 2025. If you want to try Earnio, feel free to visit www.earnio.com.

Final tally:

In the end, I got 7.5 out of 10 predictions correct, which is not a bad result. Looking ahead is not easy. In hindsight, some predictions may seem trivial, but considering the level of uncertainty at the start of 2024, it wasn’t as simple as it seems.

If you’re curious about what 2025 might bring, don’t miss the next part of this series, where I will share my predictions for 2025.