10 crypto predictions for 2024

January 5, 2024

Here are some predictions for 2024. This is my view as a trading frontman. Of course I could be wrong, I would even say it is almost certain when predicting the future. In fact, some predictions won't even be predictions, but rather statements of facts, while others may be a bit controversial and much bolder.

Of course, as always, this is by no means investment, financial, business or other advice. Cryptocurrency trading is risky, so be careful.

1. Halving in 2024 will not be as exciting as the last ones

Halving will take place sometime in the spring of 2024. Halving will occur with 100% certainty, as it is coded. It means cutting the rewards to miners for a mined bitcoin block in half. This has the de facto effect of reducing the supply of bitcoins in circulation. The previous three halves of bitcoin were followed by a gradual rise in price.

The halving is likely to cause miners who no longer find it profitable to mine to disconnect from the network, and selling pressure is likely.

II believe that even though halving will now have an effect on the price, it will not be as strong as previous attempts. After all, all the information about this event is known and the bitcoin market is more mature as well as its participants are more experienced, so the market will deal with this expected event in a more balanced way.

2. Spot bitcoin ETF will cause significant capital inflows

By the time you read this article, it is possible that a bitcoin spot ETF has already been approved. The U.S. Securities and Exchange Commission must rule on ARK's first application by Jan. 10. If it approves it, it is likely to approve other applications at the same time.

A spot bitcoin ETF would be groundbreaking for the industry because it would give institutional conservative investors access to the world's largest cryptocurrency without having to participate directly in the cryptocurrency market.

The question of how many billions of dollars can actually flow into these spot ETFs is already more difficult to answer. Comparisons to the launch of gold ETFs in 2005 might help with the estimation, but that math is complicated by the significantly higher amount of dollars in circulation, as well as the much greater financial and technological maturity of investors. For the first quarter after the ETF's approval, I see it optimistically between $2-3 billion, though I humbly add that I only read that "math" from other articles.

3. MiCA will help those who want to do it right, but it will take time in the Czech Republic

The European MiCA regulation will bring clearer rules for crypto entities and cryptocurrency traders in the EU. It is a regulation that already exists, but is waiting to take effect. The regulation is directly applicable and automatically becomes part of the legal order. However, I expect that its beginnings, especially in the Czech Republic, may be a little slow and confusing.

It will take some time to find the experts to do everything. Fortunately, Probinex has been meeting with representatives of the European and Czech parliaments from the beginning, and we are trying to represent both the public and business in this field.

4. Ethereum will have lower fees, causing a huge increase in transaction volume

Ethereum is due for another EIP-4844 upgrade to enable proto-danksharding. Ultimately, this means a reduction in transaction fees. On the other layers, it may be a reduction even below $0.01, which will make it much easier and cheaper to use DeFi and microtransaction-based applications, which will also see a bigger boom as a result.

With transaction fees this low, I also expect a huge increase in transactions on the second layers, where it will allow for more efficient trading and arbitrage. Traders will thus no longer have to use centralized exchanges and risk another problem similar to that of the centralized FTX exchange.

5. Bitcoin BRC-20 and NFT on bitcoin will continue to keep transaction fees high

Bitcoin Ordinals are a new way of creating NFTs on bitcoin. Ordinals allow immutable information to be stored on the bitcoin blockchain, making them unique and potentially valuable. Each ordinal is simply a satoshi that has been assigned a unique number, i.e. a tokenID, making each bitcoin NFT ordinal functionally unique.

Ordinals and BRC20 fill up block space, which increases the cost of transaction fees. On the other hand, by increasing transaction costs, they attract more miners. And this makes the network more secure and decentralized. But opponents argue that this brings unnecessary dead weight onto the blockchain, which then fails to perform its transactional function.

But this argument can also be reversed in the sense that it gives the bitcoin network a new use. This is a view that I share. I am against banning or forking the network. I think the market will find a use for NFT in bitcoin and if not, it will at least be a natural evolution. If these extensions of bitcoin thrive, it will be worth pursuing cryptocurrencies like $STX, $ORDI, $MAP and the like.

The increase in fees can be seen very precisely on the graph. Source: blockchain.com

6. Financial advisors to start recommending bitcoin

Financial advisors are increasingly being asked about cryptocurrencies by their clients. Due to high inflation and money printing, investors are trying to protect their assets, but willy-nilly have to resort to risky assets. There is simply no way to avoid it and they have to take risks.

When inflation reaches double digits, traditional instruments such as government bonds or real estate (we are talking about the actual return on real estate investments, net of depreciation, legal fees, etc...) are not enough and investors are forced to include risky assets in their portfolio. Otherwise, they may make a nominal profit, but after accounting for inflation, they still end up in the red.

However, investing in risky assets comes with a risk component that not everyone is able to estimate correctly in order to choose a portfolio mix that mitigates the potential danger but also sufficiently covers the top, profitable part. This is where Earnio can shine.

7. Crypto will be in the green in many areas

Here I am listing several categories at once, because I find it unnecessary to separate them. I expect both NFT activity and the price of bitcoin and other more well-known altcoins to increase. However, a quality investor must choose those altcoins or NFTs that outperform the market. Otherwise, if a manager wants to invest in cryptocurrencies, he or she should prefer to buy only bitcoin or leave it to Earnio.

With the aforementioned reduced transaction fees, the activity and number of transactions on decentralized exchanges will grow.

The profits of centralized exchanges will also grow, and Coinbase in particular, which many ETF seekers have chosen as their cryptocurrency handler, will exceed expectations.

8. Players will fail

This is one of my more controversial guesses. However, I don't expect a massively popular blockchain-based game in 2024, despite market sentiment. Although we also hold tokens focused on gaming, i.e. computer games, in our Probinex portfolio, I am skeptical in this area. Of course I will be very happy if GameFi does well, but I still can't explain why computer games need crypto.

I spent hundreds of hours as a teenager playing Dota, Magic the Gathering or CS. Not once while playing them did I think "ooo, how cool would it be if this game ran decentralized and unrestricted on a public ledger".

My thoughts were more like "oh how cool would it be if this game was more fun, faster, more interesting". And I don't see how blockchain will bring that about. I kind of feel like Gaming and Crypto are being lumped together here simply because both were originally a hobby of similar types of people. But I'd be happy to be proved otherwise.

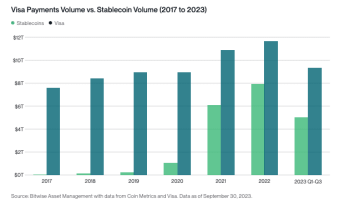

9. Stablecoins will be used more than VISA

This is also perhaps an unnecessarily bold statement. It doesn't seem like it, but stablecoins are starting to be used more and more. MiCA regulates their use within the EU, and because they are "stable" they can easily be used in international trade, where they are more useful than bitcoin for many traders.

Stablecoins are also coming into play, even generating a yield in their own right and even deriving that yield from the real world. For example, stablecoins that are backed by real bonds or real estate.

The value of stablecoins in the market is currently around $130 billion and could easily exceed $200 billion next year.

And VISA payment volumes and cryptocurrency stablecoin transactions are closer than you might expect.

Stablecoins vs. VISA. Source.: Bittwise Asset Management

10. Earnio will have AUM several times higher

And finally, one shot at my own ranks, and I don't know if my colleagues in the sales department will praise me for it. I expect that with increased public interest in cryptocurrencies and also with good results, the snowball effect will slowly start to kick in. A product with a year-long audited history is performing much better compared to a product with an audited history of three months.

Oh, and then all it takes is one financial group and Earnio Fix will have a waiting list longer than the public toilets at Christmas markets :). If you follow our social networks honestly, you already know that we are in talks with several of them.

Well, those are my predictions for 2024. What will come true and what won't, we'll see at the end of it. There is of course much more to write about (remittances, Solana and other L1s, tokenization, etc...) but this article would never have an end.

To the new year, I wish you good luck, good health and lots of success.