FTX Exchange in Shambles: What Exactly Happened and What Can We Learn From It?

November 11, 2022

Ondřej Koraba

Until recently, one of the world's largest crypto exchanges - FTX - enjoyed enormous popularity. It was considered by many to be a key player in the cryptocurrency market, which is able to withstand fierce competition. However, today FTX faces very critical liquidity problems and it is starting to look like its chances of survival are close to zero.

The circumstances of such an unprecedented crash are having a significant impact on the entire cryptocurrency market. Some are even comparing the situation to the collapse of Lehman Brothers, which started the global financial crisis in 2008.

So, what really happened and why? And is there a lesson we can take from all this?

FTX & Binance: From Rivalry to Acquisition Talks

To better understand the whole situation, it is necessary to dig a little deeper into the past and put the FTX exchange in the context of the entire market.

In the world of cryptocurrencies, countless exchanges operate allowing these digital assets to be traded. The Binance exchange has been among the largest players in the game for a long time and, until recently, the FTX exchange as well.

On both platforms, millions of people daily traded cryptocurrencies such as Bitcoin or Ethereum, but also NFTs or their native cryptocurrencies - FTT coin developed by the FTX exchange and Binance’s BNB coin.

Until recently, the two exchanges were paying rivals, although it is rather ironic that at the beginning of FTX, Binance was one of its main investors and holders of FTT.

FTX CEO Sam Bankman-Fried even revealed that Binance's initial investment in FTX amounted to tens of millions of dollars. Changpeng Zhao, CEO of the Binance exchange (nicknamed CZ) expressed that it was a strategic investment on his part, which was supposed to be one of the incentives for the growth of the cryptocurrency market as a whole.

Nevertheless, this close cooperation was short-lived and in March 2020, Binance even resorted to temporarily disabling trading of the leveraged FTT token within its exchange. According to Cointelegraph, CZ explained these steps by saying that FTT holders "did not understand the product" and were not using the token as they should.

Bankman-Fried subsequently bought all of Binance's shares in FTX from Binance in response to the actions of regulators that made it difficult for Binance to operate in Japan, Great Britain and Italy.

Insolvent Alameda, the collapse of FTT & the fatal outflow of liquidity

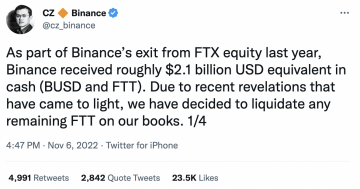

In a pretty tense atmosphere, the functioning of both exchanges continued until Sunday, November 6, when CZ launched a frontal attack on FTX. He tweeted that Binance acquired USDC and FTT worth $2.1 billion during the aforementioned buyback.

These FTT coins have been then massively sold off by Binance in recent days, significantly reducing the value of the token.

This claim and the massive sell-off came as information came to light that one of Bankman-Fried's side projects - the crypto-trading company Alameda Research - had questionable funding.

According to CoinDesk, a large part of the total assets of $14.6 billion is made up of FTT tokens, which means that Alameda did not hold its fortune in fiat currencies, but was rather reliant on a private, relatively illiquid token controlled by another Bankman-Fried company.

The total value of the FTT held by Alameda was calculated at $6.1 billion. What is indeed strange is that on its website, FTX clearly states that there is only a total of $5.1 billion in FTT in circulation.

In the shadow of Alameda's controversial financing, combined with CZ's statement, doubts began to spread about whether FTX is sufficiently solvent. Binance's sale of FTT was joined by other big market players, causing the FTT token to lose its value dramatically.

FTX clients also began massively withdrawing their deposits from accounts on the exchange, thereby further reducing its liquidity and available funds.This "war" between the giants was also reflected in the general mood of the market, and the price of Bitcoin thus fell by 11%, ETH even by 18%.

The fall down of FTT - Coingecko.com

Binance won't buy FTX after all

While on Monday Sam Bankman-Fried stated on Twitter that the information about the insolvency was just a blatant speculation, on Tuesday he turned the tables and admitted that he is actually in talks with Binance about intensive cooperation.

CZ itself confirmed on Twitter on Tuesday that FTX had asked for help due to a significant loss of liquidity. He stated that in order to protect users, they agreed with FTX on a complete buyout of the entire FTX exchange.

However, due to US legislation, the trade would only concern the non-US part of the FTX exchange. The transaction was already close, but there was still an obstacle in the way, which is the so-called Due Diligence. This involved a complete audit of FTX before it could be taken over.

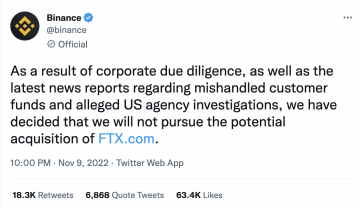

After much deliberation, the Binance exchange finally stated that it was withdrawing from its intention to buy FTX.

Portfolio diversification is the key

The problems currently drowning the FTX exchange, and above all the fact that Alameda's fortune consisted of such a large part of FTT tokens, show how important a role portfolio diversification plays in trading.

That is also why we never put "all eggs in one basket" within our own trading strategies. All our processes are very diverse and based on distinct principles. Even our handling of various tokens has a different character. It can be both LONG and SHORT, which allows us to have opposite positions on the same coin.

Compared to our entire portfolio, the exposure within one token is minimal. Probinex strategies primarily trade between 20-120 coins these days.

It is sometimes advisable to choose a FLAT strategy (i.e. not necessarily to have an open position). Sometimes it is simply better to wait for the situation to turn out in our favor. Thanks to these approaches and diversification principles, our strategies can generate long-term positive results for both our StayKing program and Earnio.

The situations of FTX and Alameda are therefore a big lesson for others. We will continue to monitor the situation and keep you posted about its development.

Do not hesitate to join our Telegram group, where we like to discuss such topics further!