December in Crypto Markets: MicroStrategy joins Nasdaq-100

January 7, 2025

Tomáš Hucík

The year 2024 is behind us and the cryptocurrency market is off to a good start. It is gradually becoming the focus of institutional investors as well as governments and the wider financial community.

It is making its way into many portfolios, and I won't even mention the fact that Donald Trump won the presidential election as a pro-crypto candidate in this article. Let's take a look at the most significant events that influenced December's market events.

US Treasury analyzes Bitcoin

In December, the U.S. Treasury Department was at the forefront of discussions about cryptocurrency regulation. They emphasise, of course, the need for a robust framework for managing digital assets, both because of their growing importance and the risks they pose to financial stability.

But what is particularly fascinating is that just a few years ago, it would have been unthinkable for the Treasury Department to even mention Bitcoin. And now, at the end of 2024, it is comparing it to gold and other assets - and not in an "imagine Bitcoin as crazy version of gold" style, but in a data-driven analytical tone. No one explains Bitcoin anymore.

Why? Because everyone knows it at this stage.

MicroStrategy joins the Nasdaq-100 index

A major milestone for the cryptocurrency sector was MicroStrategy's inclusion in the Nasdaq-100 index. The company, known for holding more than 440,000 BTC, became the first bitcoin company to be included in this prestigious index.

The move changes the way traditional markets view bitcoin and its associated businesses. Nasdaq's decision to include MicroStrategy raises the prestige of cryptocurrency firms and sets a precedent for other companies tied to digital assets. The move also demonstrates the growing integration of cryptocurrencies into mainstream investment portfolios.

Simply put, MSTR is now part of a well-known broad index - meaning that passive capital that people don't even think about is now flowing in part to Bitcoin. Nasdaq-100 ETFs are being bought by MicroStrategy. And MicroStrategy is buying Bitcoin.

You see where I'm going with this?

BlackRock recommends an allocation to Bitcoin

BlackRock, the world's largest asset manager, recommended in December that investors consider allocating 1-2 % of their portfolio to Bitcoin. This announcement reflects a fundamental change in the institutional approach to digital assets. Bitcoin, previously seen as volatile and speculative, is now seen as an inflation hedge and an asset uncorrelated with traditional markets.

BlackRock has emphasized Bitcoin's role as a "digital store of value", likening it to gold but with better portability and adaptability. This recommendation is likely to inspire other institutional investors to take similar steps, which could unleash a new wave of capital into the cryptocurrency market. This fits nicely into the narrative that most investors are still under-allocated in Bitcoin.

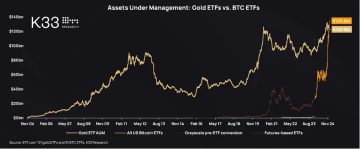

Bitcoin ETFs have surpassed gold ETFs in assets under management

In December 2024, a breakthrough moment in financial markets occurred when Bitcoin ETFs surpassed gold ETFs in assets under management (AUM) for the first time.

This milestone indicates a fundamental shift in investor preferences, which are increasingly leaning towards Bitcoin due to its easy availability and potentially higher returns. Analysts attribute this trend to growing confidence in Bitcoin ETFs as a regulated and safe way to gain exposure to cryptocurrencies. This development solidifies Bitcoin's position as "digital gold," challenging the long-standing dominance of physical gold as a safe haven. In my view, this shift is also a result of Bitcoin's more speculative nature.

If you want to get ahead of the competition, you have to take risks. And buying gold is not risky. On the other hand, overexposure to Bitcoin can be dangerous because its stability is certainly not on par with gold. Thus, its "safety character" is questionable.

Source: K33 research

The AI agent narrative

One of the major themes in the crypto world is the existence of AI agents. These are entities, or rather computer programs with some form of artificial intelligence, that are able to mimic human actions and perform them independently.

Some of them have their own tokens, and you can directly participate in their potential success. The problem, however, is recognizing what is a real project, what is memecoin, and what is just "vaporware" on the edge of fraud.

There are hundreds if not thousands of these out there. So if you are involved in trading these extremely risky assets, be careful.

Risk vs. reward

I'll close this review with a philosophical question I read somewhere (and I really can't remember where, even if you torture me). If we consider the risk/reward ratio, was it better to buy BTC at $5 or now at $100,000?

When buying at $5, the potential reward was much higher. But so was the risk.Today, it's exactly the opposite.

But the risk/reward ratio is just a number. When do you think the investment was better? I don't actually know myself, but I'm beginning to suspect that the trade is probably more balanced now than it was before.

What about our portfolio?

A conservative approach to December trading

Within our portfolio, we have been rather conservative in our trading. While December is known for its so-called Santa Claus rally, when prices go up as a gift to traders from Santa Claus, that doesn't actually happen that often. In addition, December typically sees the closing of some open long-term positions, especially for various accounting, economic, or reporting reasons.

So, we were rather cautious as well. Moreover, we are past the biggest short-term mania of Donald Trump's election (I lied a bit at the beginning of this article). Bitcoin did briefly climb to a new price high in December but then slid back down to $90,000 towards the end of month.

Strategies for futures and spot trading

We, in terms of active futures trading, also tried short (trading on the downside), somewhat surprisingly, driven mainly by the bad news around the USDT stablecoin being delisted from Coinbase. Some of these trades were closed in profit, while others ended in a small, managed loss.

As for trading spot cryptocurrencies like Bitcoin or ETH, we currently have buy limit orders set there at lower price levels in case the market decides to head a bit lower or there is some sort of short-term correction. In fact, before Donald Trump's actual inauguration (that's the last time, I promise), the market could still be quite volatile.

Our Altcoin portfolio, which is currently operating with about 25 % of capital, has invested in leaders across all the more well-known categories. Most positions are currently in profit, but we are not closing that out yet. We are sticking to our strategy that quality cryptocurrencies still have the potential to grow.

December StayKing and Earnio

Thus, our own trading contributed about USD 30,000 to StayKing in December. However, we are distributing PBX worth USD 217,000, as the huge lion's share of the contribution comes from trading in Earnio for November.

Earnio ended November with a 9.51 % result and contributed $187,193 to the December StayKing.