September on the Crypto Markets: Fed Cuts Rates and Bitcoin Holds Range

October 6, 2025

Tomáš Hucík

What about our porfolio?

We stayed the course in September: no profittaking, no leverage, and no changes to the spot lineup. Our exposure thus remained north of 90% across BTC, ETH and our selected altcoins. As usual, we inched stoploss levels higher under fresh supports to protect accrued gains while giving the trend enough room to work. And because we didn’t close any positions in September, there is no PBX distribution via StayKing this month—we only distribute realized profits from closed trades, the same principle we highlighted earlier this summer.

If we look at the summary of our positions, all of those are doing quite good.

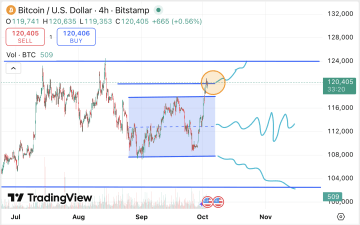

Bitcoin (BTC) range held, quarterly close was still strong despite mid-month crash. BTC spent the month oscillating mostly between ~$108k and ~$118k, with a monthend close at $114,048. Intramonth, the local low printed around $108.4k and the local high near $117.9k (Sep 18), keeping BTC inside August’s breakout box. On a higher timeframe, Q3 still closed at/near record territory, keeping the cyclical uptrend intact. Our position is therefore sitting nicely in a modest open profit comfortably waiting for another push up.

Source: tradingview.com

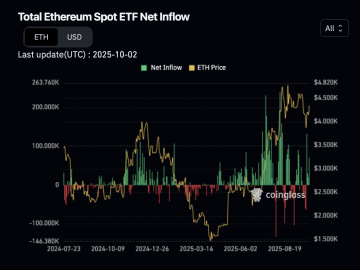

Ethereum (ETH) was choppy on ETF flows, but market structure seems intact. If companies consider the bitcoin trade too crowded, they might move towards ETH.

ETH finished at $4,144 on Sep 30. The sharp Sep 25 flush (worst day of the month) coincided with a heavy weekly outflow spike from U.S. spot ETH ETFs. ETH underperformed BTC on a monthly basis but still manage to defended the 4 000 price. Our position is thus nicely up and poised for even bigger uptrend.

Source: coinglass.com

Solana (SOL) is making ETF headlines trading in a wide range so far. SOL ranged ~$191–$253 in September and closed near $209. Sentiment pivoted around spotETF headlines: the SEC extended review windows during the month and, by monthend, a shutdown risk threatened to push timelines further. Price held the prior breakout area regardless.

Chainlink (LINK) is consolidating after a strong summer.

LINK spent September rotating in a $20–$26 band (most closes clustered $21–$24). Narrative remained anchored to expanding oracle integrations into traditional finance rails, with fresh coverage late in the month/early October helping to sustain highertimeframe momentum despite chop.

Binance coin (BNB) had a very good run fueled by growing activity on its blockchain and with strong user activity came also the price bump. BNB is currently trading for over 1000 USD for the first time in history.

All of these altcoin positions are doing doing well with BNB exceptionally well although these are also most susceptible to prolong drawdowns compared to bitcoin. All of our positions are prepared for a potential drop in prices with protective stop loss orders that would still end them in a profit. Although we would much rather if the growing trend continues.

We continue to think in scenarios rather than singlepoint forecasts. Levels below are zones, not exact ticks.

Summary of developments in September 2025

Breakout continuation

BTC: A firm weekly close above $118.5–$120k would put the prior ATH zone (~$124–$125k) back on deck and open room toward the $130–$135k measured move later in Q4. ETH would likely follow if it reclaims $4,450–$4,650, converting that supply into support. One nearterm tailwind is the easier rates backdrop postFOMC if risk appetite broadens and September’s ETF wobbles subside. We will be monitoring whether latemonth net ETF inflows repeat in early October.

Source: tradingview.com

Range persists (our base case for now)

BTC: $108–$118k remains a logical equilibrium until a catalyst breaks it (ETF calendars, macro data during the shutdown).

ETH: $3.8–$4.4k chop as ETF flows toggle between out- and inflows.

Altcoins: rotation rather than trend—SOL reactive to ETF headlines (review windows now dangling into October/November), LINK steady so long as enterprise integrations stay in the news cycle.

Deeper pullback (risk case)

BTC losing $108k on a weekly basis risks a fast run into $102–$105k support. ETH would likely revisit $3.6–$3.7k where demand last absorbed the Sep 25 washout. The obvious triggers: a string of ETF outflow weeks (especially in ETH) and prolonged regulatory delays while the SEC operates with a skeleton crew during the shutdown. In that tape, alts (SOL, LINK, BNB) typically underperform BTC by an extra 5–15 percentage points on drawdowns.

Macro Situation: Fed Eases as Markets Eye a Pivot

September’s macroeconomic backdrop set the tone for crypto markets. In mid-month, the U.S. Federal Reserve delivered a widely anticipated 25 basis point interest rate cut, bringing the target range down to 4.00–4.25%. This marked the second rate reduction of the year and the first since late spring, confirming that monetary policy had decisively shifted toward easing. Fed officials signaled more cuts ahead – two additional quarter-point trims were penciled in for Q4 – citing a softening labor market and slowing job growth as primary concerns. Fed Chair Jerome Powell emphasized rising unemployment risks and noted that recent data showed payroll expansion below break-even levels, warranting a more accommodative stance. The dovish tilt was reinforced by cooling inflation (around ~2.7% year-over-year in late summer) and mounting political pressure for easier policy. Notably, President Donald Trump – inaugurated earlier in 2025 – had openly called for steeper cuts, even attempting to shake up Fed leadership to accelerate monetary easing. While the Fed didn’t go as far as some hawks wanted (a new Trump-appointed governor dissented in favor of a deeper 50 bp cut), the direction was clear: the era of tightening was over, and liquidity conditions were set to gradually loosen.

Source: cryptoquant.com

These cross-currents translated into higher volatility for cryptocurrencies. In the days surrounding the Fed’s Sept. 17 meeting, Bitcoin and its peers saw swift moves as traders parsed the implications of easier policy. By mid-month, bitcoin market shed roughly 8% in a broad risk-off move. More than $1.7B in leveraged crypto positions were liquidated during the mid-September swoon, indicating many traders were caught off guard.

Still, by late September there were signs the storm had passed. The Fed’s dovish outlook (with rate cuts likely again in October and December) bolstered the medium-term bullish case for risk assets, including crypto, as lower rates historically support speculative investments.

Bitcoin: Breaking the September Curse

Historically, September has been a bogeyman for Bitcoin – the only month that reliably delivered negative returns in past cycles. But 2025 flipped the script. Far from a “Rektember,” Bitcoin ended this month notably higher, defying seasonality with one of its best September performances on record. This is remarkable given that on average Bitcoin loses 5–8% in September during bull markets. The fact that BTC held gains instead of succumbing to its usual autumn slump was a major psychological win for bulls and signalls a fundamental shift in market structure. is on the table gave a boost to sentiment around those ecosystems.

Several factors underpinned Bitcoin’s firm footing. First, the supply dynamics have never been tighter. Over 72% of the circulating BTC is now classified as illiquid – held off exchanges in long-term wallets – which is the highest such proportion in Bitcoin’s history. In other words, nearly three-quarters of Bitcoin supply isn’t readily for sale, creating a supply crunch.

Secondly, institutional and corporate demand is robust. Companies like Strategy (formerly MicroStrategy) kept adding to treasuries – Strategy’s holdings reached nearly 597,000 BTC by mid-year – and a host of Bitcoin ETF products saw surging inflows. These deep-pocketed buyers aren’t swayed by seasonal trends; their systematic accumulation and new investment vehicles (like spot ETFs) have changed the market’s character. ETF flows have become a key determinant of Bitcoin’s price performance, with changes in ETF holdings explaining an all-time high share of BTC’s moves.

Market sentiment around Bitcoin remained optimistic despite volatility and despite occasional whining on crypto twitter. The fact that BTC made a new all-time high in August (breaking above its 2021 peak) has kept the bullish narrative intact. September’s consolidation was seen as a healthy pause following that breakout.

Corporate involment

Institutional adoption showed up in corporate actions and strategic moves. Perhaps the most striking statistic is that public companies now collectively hold over 850,000 BTC on their balance sheets– about 4% of the total supply – signaling a strong vote of confidence in Bitcoin as a long-term store of value. Tesla retained its ~10,500 BTC. Newer entrants joined the fray too: in July and August, corporate upstarts like SharpLink Gaming made waves by accumulating 280,000+ ETH as a treasury asset, and even CEA Industries announced holding BNB (Binance Coin) as a reserve, which oddly sent its stock up 800% on that news.

One of the top stories and emerging narratives is Stablecoin issuers. Almost every big financial group, company, fintech startup or bank is mulling over the launch of their own stablecoin or already has it out. Circle, Tether, MakerDAO, Paxos, Crypto.com, Kraken, PayPal, Société Générale, Fiat Republic, Revolut, Standard Chartered, Plasma, Hyperliquid, World Liberty Financial, Mastercard, Visa, MoonPay, Cloudflare, Stripe and many more are entering stablecoin playground in order to capture this fast moving market.

Perhaps the most ambitious institutional project disclosed in September came from the heart of Europe’s banking sector. On September 26, Italy’s UniCredit and eight major European banks (including ING, KBC, Danske Bank, and others) announced a consortium to launch a euro-denominated stablecoin on blockchain. This proposed “Bankcoin” – expected to roll out in 2026 under full MiCA regulation – aims to be a pan-European digital payment standard backed 1:1 by euro reserves. The significance of this cannot be overstated: it’s traditional banks directly creating a crypto asset to compete with private stablecoins and harness blockchain’s efficiency. They explicitly framed it as an effort to provide a European alternative to USD-dominated stablecoins, seeking to set a common EUR-native digital rail for cross-border settlements. For crypto markets, the message is clear – huge financial institutions see value in crypto tech and don’t want to be left behind. Even if the stablecoin won’t launch immediately, the planning and public commitment represent a big step in legitimizing crypto assets within conventional banking. It also potentially foreshadows greater institutional liquidity in crypto denominated in euros, which could broaden the market beyond its U.S.-centric base.

Derivatives Platforms’ Turf War Heats Up

One of the most fascinating subplots of 2025 has been the battle among cryptocurrency derivatives platforms, particularly in the on-chain (decentralized) derivatives sector. By September, this competition reached a fever pitch as new players with cutting-edge technology challenged both the DeFi incumbents and even centralized exchanges on their own turf. The race to offer traders the fastest, most liquid, and most feature-rich derivatives venue is reshaping where and how crypto volume flows.

At the center of this fight is Hyperliquid, a name that has surged to prominence over the past year. Hyperliquid is a decentralized exchange (DEX) for perpetual futures that operates on its own custom Layer-1 blockchain, optimized for speed. It has been nothing short of a juggernaut: as of September, Hyperliquid commanded roughly 38% of the entire DeFi perpetuals market, making it the single largest on-chain perps venue. In July 2025 alone, Hyperliquid notched an eye-popping $319 billion in trading volume on its platform, shattering records for DeFi trading. To put that in perspective, those volumes rivaled or even exceeded some traditional centralized exchanges’ crypto futures volume.

But the competition is ruthless. Trading derivatives on leverage generates lot of reccuring fees that stack up quickly, so many players are moving to this space, that was previously occupied by centralized big entities. Lighter, Aster, Pacifica, Hyperliquid, Variational, EdgeX, Extended, Backpack, Paradex, Reya, Ostium, Vest, Sunperps, Ranger, Avantis, BasedOneX These are some of the decentralized trading venues where users can trade. But let’s be honest — a lot of that volume is just wash trading for points and airdrops. The big question is how many of these can retain customers once rewards and incentives run out?

Heading into Q4, the focus shifts to whether Bitcoin can break decisively above its $125K resistance, whether Ethereum’s spot ETFs sustain inflows to push ETH beyond $5K, and how quickly regulators in the U.S. and Europe deliver on promises of clarity. If September was any guide, the final quarter of 2025 could bring both breakout rallies and fresh structural shifts — with institutions, regulation, and technology upgrades converging to redefine crypto’s role in the global financial system. There are strong hints that this move from fringe to mainstream wont be stopping anytime soon.

Veškeré informace uvedené v tomto článku a jeho obsah nemá sloužit jako investiční poradenství, doporučení či závazný návod k finančnímu rozhodování. Společnost Probinex nenese odpovědnost za jakékoli rozhodnutí učiněné na základě těchto informací. Každý čtenář by si měl před jakýmkoli investičním krokem provést vlastní analýzu a případně konzultovat odborníka.