StayKing results february 2024

March 6, 2024

Tomáš Hucík

February is the shortest month of the year, which means you have the least amount of time to make the most of the markets. But that can never derail skilled traders.

Bitcoin has consolidated around the $43,000 price level. But as it gradually became apparent that the demand for bitcoin was not falling, but rather the opposite, the price was driven up.

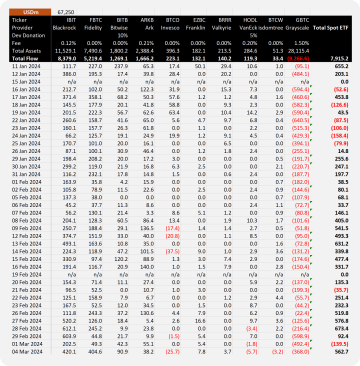

This was mainly due to the huge demand coming from the ETF funds. All funds, with the exception of GBTC, basically accumulated bitcoins at a huge rate throughout February, which took many analysts by surprise. Bitcoin ETFs only had one negative day in February, when the amount of bitcoin the funds were buying out of the market was smaller than the amount of bitcoin the funds were selling into the market.

Table of inflows and outflows of bitcoin ETFs. Source: @BitMEXResearch

Early in the last week of February, Uniswap (UNI), the largest decentralized exchange by market capitalization, saw a significant price increase following the release of a proposal by the Uniswap Foundation detailing a redesign of the current project management system. As outlined in the proposal, UNI token holders who stack or delegate their tokens would be eligible for rewards from project revenues.

However, the distribution of profits may, in the eyes of the SEC (US Securities and Exchange Commission), mean that the token model is more akin to a security than a commodity. And it is the SEC that is fond of targeting tokens that resemble securities. The fact that the largest decentralized exchange would take such a step may indicate that they feel they have a strong position vis-à-vis the SEC. This could then be a signal for other protocols to take a similar step if they do not want to be left behind. Ultimately, it would mean more rewards for users in particular, and therefore more reasons to use crypto protocols.

At the end of the month, Ethereum's price continued to struggle to suppress bitcoin's dominance when it headed towards 0.06 on the ETHBTC pair for the first time since the introduction of bitcoin ETFs in early January. However, as before, the pair encountered strong resistance at 0.06, leading to a quick rejection and subsequent decline to 0.056 by Wednesday, coinciding with a rise in the bitcoin price above $59,000.

Still, the Ethereum price is at its highest level since March 2022, currently trading around $3,500 at the time of writing. Market confidence continues to grow with the possible regulatory approval of a spot ETF on ETH in the near future. The question is whether the demand for BTC will continue to be so intense that it will surpass the potential demand for ETH if ETFs are approved. If you want to know more about the potential of ETF for ETH being approved, check out our podcast!

ETHBTC graph. Source: tradingview.com

At the very end of the month, memecoins began to rise along with bitcoin. But strengthening is an understatement, memecoins were literally pumping. Memecoin is a term for cryptocurrencies that have no real purpose, they are basically just a community token that represents an internet joke or an affection for an animal, for example. When memecoins are pumping, it can mean the market is overheated and a correction is about to happen, so it's important to be careful.

And how has the situation affected our portfolio?

Because the price of bitcoin and the cryptocurrency market is going up, we haven't had to change our strategy significantly.

As the bull run comes, we are gradually activating more of our strategies in the growth market. The Defi and Venture Capital (venture investing in start-ups) part of the portfolio, which focuses mainly on low-cap cryptocurrencies, currently has 10% of our capital allocated.

The spot position remains unchanged for the time being. We are gradually moving the stop loss higher, so in the event of a market fall we will definitely be in profit and we are waiting for a market correction that would allow us to enter the market with another part of the capital. This is the best situation for a trader when he is not threatened with loss and can fully concentrate on the profit itself.

However, should the uptrend weaken significantly, partial profit-taking is in order. Indeed, the current pumping on memecoinch may (but not necessarily) precede a price correction. Indeed, the last hurdle of the technical analysis is ahead, namely ATH. The highest price achieved.

When you manage institutional funds, greedy profit chasing is not and must not be your goal, especially when portfolio trading fuels the running of the entire company. The market will not run away from you. If you're there a month or two later, profits will still be good. It's especially important to be stable in the fundamentals. That's the difference from managing your own private portfolio, where you can afford to take a much bigger risk because it's just your assets and they affect only you.

And how did this month turn out?

Because we have not yet taken any profits on the spot and we are keeping an open profit there, we are distributing the profits generated by trading futures derivatives among our clients. This month, 269,850 PBX worth $49,563 is being distributed this way. On average, clients accrue 0.054%. The January earnings from Earnio contributed a nice sum of USD 6,065.