November on the Crypto Markets: Crypto Market Crash & Liquidity Meltdown

December 5, 2025

Tomáš Hucík

What about our porfolio?

November 2025 will be remembered as one of crypto’s ugliest months in recent years. Prices saw steep declines across the board, erasing much of the year’s prior gains. Bitcoin, for example, shed more than $18,000 in value during the month, logging its worst monthly dollar loss since the May 2021 crash. From its peak to trough, BTC fell roughly 33%, a dramatic pullback that had even long-term holders unnerved. Ethereum and other majors weren’t spared either – Ether dropped over 20% in November (its biggest slide since early 2024), and high-flying altcoins plummeted even harder in many cases. By month’s end, charts were a sea of red, and years-old support levels were being tested. The velocity of the drop – with double-digit percentage losses occurring within days – indicated a market in full retreat.

The chaos that erupted in October continued in November, extending the market’s downward spiral and confirming that the previous month’s collapse was not an isolated shock but the beginning of a deeper structural reset. After the biggest liquidation event in crypto history forced traders to finally confront how dangerously overexposed they were, November brought a second wave of pain. Liquidity evaporated, sentiment broke down, and risk appetite across global markets continued to freeze. Mid-month investors were increasingly afraid that anticipated rate cuts might not materialize, despite the market desperately pricing in future easing, the environment became toxic for any form of high-beta speculation. Add to that the rising geopolitical uncertainty tied to Venezuela, and November evolved into an environment where caution was not just encouraged but essential.

Against this macro backdrop, our decision to stay completely out of the market, with no open positions.

Our capital is fully withdrawn since October and it proved proved to be one of the strongest strategic calls of the recent period.

Since no trades were made in November and will pulled our capital from the market, there will be no PBX tokens distributed to the participants of Stayking programme.

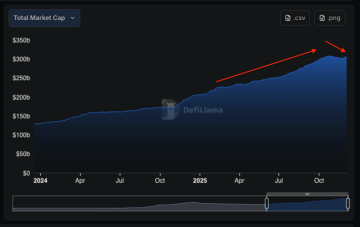

The most striking feature of November was the abrupt intensification of derisking. Traders who had survived October’s shock attempted to re-enter early in the month, only to be met with relentless selling pressure that punished every premature attempt at bottom-fishing. Stablecoin supply contracted , a clear sign of capital fleeing the ecosystem.

Source: defillama.com/stablecoins Stablecoin supply dropped in November for the first time in a year.

Funds and institutional vehicles that had been aggressive buyers in earlier rallies turned into net sellers, redeeming positions rapidly as volatility refused to cool. What emerged was a market devoid of confidence, structure, and depth. By standing aside, we avoided every trap that caught overleveraged players and even cautious participants who were lured in by the illusion of “cheap” prices.

From a technical perspective, Bitcoin confirmed a decisive trend reversal. After failing to reclaim the $100,000 region, BTC broke down from its long-term ascending structure, slicing through support levels that had held for over a year. The weekly RSI fell into oversold territory for the first time since the bear cycle of 2022, indicating severe momentum deterioration. The 50-day moving average crossed below the 200-day, forming a textbook bearish death cross that historically precedes prolonged downtrends. Each bounce attempt was shallow and short-lived, showing enormous supply pressure at every resistance layer. When BTC lost the $90,000 handle, the market entered a liquidity void, accelerating toward lower zones with minimal bid support. Technically, the chart sent a clear message: the bullish structure was at least temporarily broken, and the market had no business being bought until clarity returned.

Source: tradingview.com Bitcoin dropped sharply in November, breaking 100 000 and even 90 000 support line.

The damage outside Bitcoin was even more brutal. Established altcoins in the top thirty experienced cascading sell-offs as liquidity left the ecosystem. Solana, which had been a standout performer earlier in the year, suffered one of the steepest declines as high-beta risk assets were dumped indiscriminately; months of gains were erased in a matter of sessions. Even fundamentally solid networks faced indiscriminate selling as correlations tightened and capital rotated fully out of crypto. These declines were not normal market corrections—they were capitulation-driven crashes fueled by leverage unwind, liquidity deficits, and evaporating confidence.

All of this reinforces how strong our positioning was. By refusing to re-engage the market after withdrawing capital in October, we successfully avoided both phases of the collapse: October’s historic liquidation and November’s grinding structural breakdown. While others were caught in cascading losses, we preserved capital entirely. We experienced no drawdown, no forced decisions, and no exposure to collapsing liquidity.

Capital protection is often undervalued during euphoric phases, but November proved why it remains the foundation of long-term performance.

Yield Spike and Recession Jitters Rattle Markets

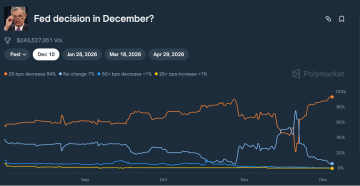

Bond yields surged unexpectedly in November, triggering fresh recession anxieties across financial markets. Investors grew nervous that the Federal Reserve might delay or even cancel its long-anticipated rate cuts as higher long-term yields threatened tighter financial conditions. U.S. Treasury yields spiked to multi-month highs, stoking fears that economic growth could stall if borrowing costs remained elevated for longer. This yield shock rattled equities and crypto alike, with risk assets selling off amid the uncertainty. Market chatter turned to whether the Fed’s planned easing cycle could be pushed back – a prospect that added to the risk-off mood.

Despite the jitters, prediction markets signaled that traders still expected a rate cut on schedule. On Polymarket, a popular crypto prediction platform, odds for a December Fed rate reduction barely wavered, with bettors assigning roughly a 90% probability to a quarter-point cut at the upcoming FOMC meeting.

Source: polymarket.com Bettors and traders were scared mid-november but not firmly believe the cut will happen.

In other words, even though volatility was present, the consensus bet is that the Fed would proceed with easing. The divergence highlighted the fragile sentiment: economic pessimism had risen enough to spook markets, yet most forecasters (and betters) are holding firm to the view that a recession-induced policy pivot was imminent. The result was a tense push-and-pull between fear and optimism – fear that the Fed might pause on relief versus optimism (per prediction markets) that a rate cut was still in the cards.

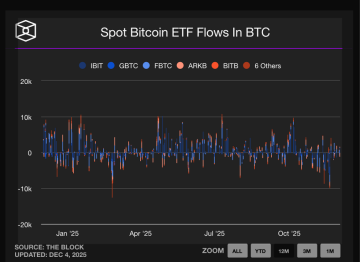

Record Bitcoin ETF Outflows Amplify Selloff

Crypto markets were hit with a one-two punch in November: not only were prices falling, but investment funds saw a mass exodus of capital. In fact, Bitcoin ETFs bled funds at a record rate, worsening the sell-off. U.S. spot Bitcoin exchange-traded funds saw roughly $3.79 billion in net outflows for November – the largest monthly outflow ever, surpassing the previous record set in February ($3.56 billion).

Source: tradingview.com BTC ETF outflows were extremely strong.

These forced selling flows created a feedback loop – as prices dropped, more skittish investors pulled money from funds, which in turn drove further asset sales. There were a few silver linings (for instance, a trickle of inflows into certain alternative crypto ETFs as some investors rotated into products for Solana and XRP), but those were marginal compared to Bitcoin’s torrent of outflows.

Steep Declines and Extreme Fear Grip the Market

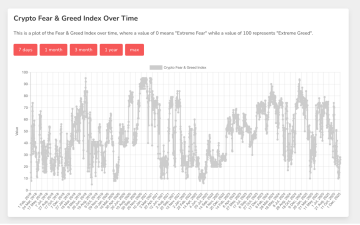

Unsurprisingly, sentiment hit extreme lows as fear took hold. A popular barometer of market mood, the Crypto Fear & Greed Index, plunged to 11 by mid-November – firmly in “Extreme Fear” territory and the index’s lowest reading since late 2022. This capitulatory mindset was palpable: even neutral news seemed to be interpreted in the most bearish possible light, and social media was rife with comparisons to prior bear-market nadirs. Metrics from derivatives markets confirmed the panic. These liquidation waves further exacerbated the price declines, creating a vicious cycle of forced selling. Historically, such extreme fear readings have preceded market bottoms, but at least for November, any recovery hopes were tempered by the immediate reality of heavy losses and shaken confidence.

alternative.me. Fear and Greed index recorded its lowest marks since 2022.

Crypto Hacks Surge to Multi-Year Highs

November was also one of the biggest months for crypto hacks on record. The biggest incident targeted Balancer, a DeFi liquidity protocol, which suffered an attack draining about $113 million from its smart contracts. Not far behind was a breach at Upbit, a major South Korean exchange, where a hacker siphoned roughly $30–36 million worth of crypto from a hot wallet. Several other platforms were hit as well, Yearn Finance saw an attacker exploit a flaw to mint excess yETH, causing over $9 million in losses, and lesser-known projects like Bex lost eight-figure sums.

Czech National Bank Buys Bitcoin

In a development few saw coming, a European central bank officially bought Bitcoin for the first time. The Czech National Bank (ČNB) revealed in mid-November that it has acquired about $1 million in digital assets, primarily Bitcoin, as part of a test pilot program. This digital asset portfolio – which also includes some USD stablecoins and a tokenized bank deposit – is being held outside of the country’s official reserves for now, in a segregated “test portfolio”. The goal, according to ČNB, is purely experimental: to gain hands-on experience with buying, custodying, and managing cryptocurrencies in a controlled manner. Over the next two to three years, the Czech bank will evaluate how these assets perform and how the internal processes handle everything from secure key management to compliance and volatility management. Importantly, the central bank made clear this does not yet signal an investment policy shift – Bitcoin is not (yet) being added to the country’s reserve mix, and there’s no plan to actively increase the crypto holdings in the near term.

This is undeniably a bullish milestone. It marks the first time a central bank within the EU has built out an operational framework to directly handle Bitcoin at sovereign scale (even if only for testing). Analysts noted that this reduces one of the psychological barriers around institutional adoption: Bitcoin is now being treated as something a central bank might need to manage someday, not just an off-limits speculative toy.

Veškeré informace uvedené v tomto článku a jeho obsah nemá sloužit jako investiční poradenství, doporučení či závazný návod k finančnímu rozhodování. Společnost Probinex nenese odpovědnost za jakékoli rozhodnutí učiněné na základě těchto informací. Každý čtenář by si měl před jakýmkoli investičním krokem provést vlastní analýzu a případně konzultovat odborníka.