What’s in store for crypto in 2026? Here are our 10 predictions

January 19, 2026

Tomáš Hucík

Will 2026 bring record capital inflows into U.S. spot crypto ETFs and turn crypto into an even more “mainstream” asset class? Will corporate blockchains stop being mere experiments and become real infrastructure? Probinex Trading Frontman Tomáš Hucík presents ten bold crypto predictions for 2026.

Just like last year, I’ve put together a list of predictions on where the trends we can already see today might lead. In my view, 2026 will bring traditional finance and crypto even closer together: ETF-style products will normalize exposure, companies will start using blockchain more practically, and stablecoins will move to the center of economic debates.

At the same time, activity will continue shifting toward applications and on-chain markets, while regulatory pressure will increase demand for privacy and open up new conflicts as well as new opportunities.

Below are 10 concrete predictions on where the market could be heading.

1) U.S. spot crypto ETF net inflows will exceed $50B in 2026

ETF rails are still the cleanest bridge between traditional portfolios and crypto exposure. 2025 already proved demand is real, now distribution will deepen.

Bitcoin ETF inflows will lead the way, but altcoins will also contribute to the total. Source: coinglass.com

In 2026, I expect net inflows into U.S. spot crypto ETFs to exceed $50B as more wirehouses ease restrictions, advisors get comfortable allocating, and large platforms broaden access. BTC and ETH should keep leading, but the next leg comes from product expansion: more spot offerings like SOL, XRP, HYPE, DOGE, AVAX and many more will appear.You can also add to that wider shelf-space across major intermediaries.

The key is behavioral. ETFs make crypto feel like “a normal asset class.” Once it’s a checkbox allocation for mainstream portfolios, flows become structural rather than hype-driven.

2) Corporate L1s will graduate from pilots to real settlement infrastructure

For years, corporate chains were mostly experiments: internal proofs of concept or marketing. I think that changes. I expect at least one major enterpriselike bank, cloud provider, or ecommerce platform to launch a branded corporate L1 that settles over $500 milion of real economic activity and runs a production bridge into public DeFi.

The model will look vertically integrated: regulated issuers and banks permissioned at the validator layer, with public chains used for liquidity, collateral, and price discovery. This will clarify the market’s split: neutral public L1s competing as open infrastructure, and corporate L1s optimized for a specific vertical with compliance built in. Both will coexist but the “toy pilot” era ends.

This is basically upgrade on my last year prediction about a bank launching a Stablecoin but this time it is more infrastructure focused.

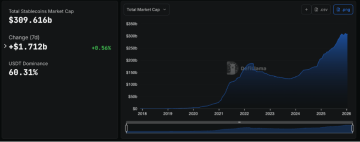

3) Stablecoins will be blamed for destabilizing an emerging market currency

This whole post is really about one thing: stablecoins are being used more and more by normal people, businesses, and capital markets and they’re crossing the line from “crypto niche” into something that actually matters for countries. Yes, their market size will keep growing, and we can all play the boring game of guessing how high the number climbs. But the more interesting bet is what happens because stablecoins become everyday money rails.

In high-inflation emerging markets, people will naturally protect savings by moving into safer options like dollar and stablecoins are easily accessible and suitable for this. For citizens, it’s rational risk management. For central banks, it looks like capital escaping their control and weakening local monetary policy.

In 2026, I expect at least one government or central bank to publicly blame stablecoins for currency instability and “monetary sovereignty” problems. They’ll be wrong, people don’t flee into stablecoins if the local currency is sound but the scapegoat narrative will be loud, and it will shape regulation and headlines.

4) The ratio of application revenue to network revenue will double in 2026

In 2026, I expect the ratio of application revenue to network revenue to roughly double, because the real fee engine onchain is no longer the base layer.

It’s what people actually do: trading, DeFi, wallets, and consumer apps. This might sound complicated, but the point is simple: the era where a blockchain had value just because it’s a blockchain is long gone.

You need to be used for something and be good at it. That’s also why I think at least one general-purpose L1 will stop pretending pure neutrality is enough and will enshrine a revenue-generating application at the protocol layer, funneling economics back to its native token. Taking cues from what worked in app-first ecosystems (think the Hyperliquid-style model) and responding to growing pressure to prove sustainable token-level value.

5) DEXs will capture more than 25% of combined spot trading volume by end of 2026

CEXs will still dominate onboarding and the “easy first trade,” but the structural pull toward onchain spot is relentless. DEXs offer composability, permissionless access, and often better fee efficiency. Especially as market makers get more comfortable deploying liquidity onchain. The UX is improving, and liquidity routing is getting smarter. Today, DEXs sit around 16% share of spot volume.

Source: theblock.com

In 2026, I expect that share to push above 25%. The driver won’t be ideology, it’ll be pragmatism: faster listings, fewer friction points, and more integrated trading flows across wallets, apps, and protocols. The moment DEX execution feels “normal,” volume follows.

6) The combined market cap of privacy tokens will exceed $100B by end of 2026

As crypto becomes “real finance,” the environment also becomes more controlled. In Europe especially, I expect stricter tax enforcement, heavier reporting duties, and more surveillance-style tooling around transactions and wallets.

And here’s the pattern: when monitoring increases, a meaningful slice of users naturally gravitates toward privacy options not to “do crimes,” but to protect balances, salaries, business flows, and personal financial dignity.

The more money sits onchain, the less people accept that everything is publicly visible forever. In 2026, I see privacy usage expanding materially, pushing the sector above $100B in combined market cap. Coins with a real shot might be: Monero (XMR), Zcash (ZEC), Railgun (RAIL) and others in “privacy” section.

7) Onchain vaults (“ETFs 2.0”) will double in AUM

Most people still haven’t heard about on-chain vaults but in 2026 that changes. They are kind of the onchain version of investment funds: you deposit assets (like USDC, ETH, BTC), and specialized curators allocate capital across DeFi strategies to generate yield. Vaults exploded from near-zero to a few billions, then got humbled by volatility and sloppy risk controls. That pullback is healthy.

When choosing the right on-chain curator, their approach to risk management is especially important. Source: defillama.com

If this category is going to manage serious money, institutional-grade risk management becomes mandatory, not optional. In 2026 I expect a wave of top-tier curators to enter, attract fresh capital, and push vault AUM to at least double. Fast enough to capture mainstream finance interest.

8) Polymarket weekly volumes will consistently exceed $2 Bilion and a federal investigation will hit prediction markets

Prediction markets are turning into one of crypto’s most addictive use cases: clear outcomes, nonstop news catalysts, and opinions priced in real time.

Polymarket is already approaching $1B in weekly notional volume and in 2026, I expect it to consistently exceed $2B as liquidity deepens, distribution improves, and more algorithmic (and AI-assisted) flow increases trading frequency.

Gambling disguised as trading. But be careful — even here you’ll find professionals who make a living from it. Source: defillama.com

And this is a two-part prediction—because the first part feeds the second, and it’s way more fun this way. As volumes and open interest surge, the incentives to exploit privileged information surge with them.

With pseudonymous participation and fast-moving markets, insiders will be tempted to front-run or manipulate outcomes—especially around politics, sports, and major news events.

That’s why I expect at least one federal investigation tied to insider trading, market manipulation, or game-fixing connected to an onchain prediction market, sparked by suspicious price action that moves before the public story breaks.

9) Gamers won't succeed

This point is a bit of a cheat. I decided to copy it word for word from the 2024 and from 2025 prediction because I stand by that prediction EVEN in 2026. And I stand by it even though I am currently testing and playing a new, interesting blockchain-based game that is being developed right here in Czech Republic. If you are also interested in testing out this new card based game and want try it out, send me a message on Telegram at @tomhucik_probinex

“This is one of my more controversial predictions. However, I don't expect a massively popular blockchain-based game in 2024, 2025 or 2026, despite market sentiment. (…), I am skeptical in this area. Of course, I will be very happy if GameFi does well, but I still can't explain why computer games need crypto.

I spent hundreds of hours as a teenager playing Dota, Magic the Gathering or CS. Not once while playing them did I think "ooo, how cool would it be if this game ran decentralized and unrestricted on a public ledger".

My thoughts were more like "oh how cool would it be if this game was more fun, faster, more interesting". And I don't see how blockchain will bring that about. Here I kind of feel like Gaming and Crypto are being lumped together simply because both were originally a hobby of similar types of people. But I'm happy to be misled.”

10) Digital Asset Treasury (DAT) companies will be shutting down

More than five Digital Asset Treasury (DAT) companies will likely end up selling assets, being acquired, or simply going bankrupt. Following a sharp increase in the number of DATs in the second quarter of 2025, the market value to net asset value (mNAV) premium began declining around October, and the market premium for this sector has largely evaporated since then, with mNAV approaching 1.0.

As the rush of companies with this DAT model slowly subsides, the next phase will separate the permanently viable operators from those who entered the market without a systematic strategy.

To succeed in 2026, DATs will particularly need a plan, a disciplined approach to liquidity and returns, and closer ecosystem alignment. Simply put, it's no longer enough to just show up, buy cryptocurrencies, and hope the market will somehow sort it out. Yes, it will sort it out, but more likely by these companies shutting down.

Investing in cryptocurrencies is associated with a high degree of risk. The value of cryptocurrencies can fluctuate rapidly, which can lead to significant gains, but also losses. Before investing in cryptocurrencies, always thoroughly research the market, consider your financial capacity, and consult with an expert. Historical performance is not a guarantee of future results.

Nothing in this article constitutes investment advice, financial counsel, or an offer or invitation to buy or sell any financial instrument. All information provided here is for educational and informational purposes only.

Probinex bears no responsibility for any losses caused by investment decisions made based on our information. Only invest funds that you can afford to lose.