December on the cryptocurrency markets: volatility at year-end

January 6, 2026

Tomáš Hucík

December 2025 was for cryptocurrencies exactly the kind of year-end finale that no one wished for. Hopes for a seasonal “Santa rally” literally evaporated, as market conditions remained challenging and unpredictable.

Bitcoin started the month with another sharp sell-off. A drop to around USD 80,000 wiped out nearly USD 1 billion in leveraged positions.

This risk-off shock on December 1 brought renewed momentum to the ongoing large-scale sell-off and underscored how fragile market sentiment still was.

The long-awaited Fusaka update for Ethereum was launched on December 3 and improved the scalability of the network.

In mid-December, additional exchange-traded funds for Solana and XRP appeared on U.S. markets; however, even these positive developments provided only short-term relief.

Overall sentiment remained at extremely low levels. By the end of December, the Crypto Fear & Greed Index was hovering in the “extreme fear” zone (around the low 20s),reflecting persistent concerns about macroeconomic pressures and recent market shocks.

In this environment, our decision to remain completely out of the market throughout December and not trade proved to be the correct strategic choice.

We hold no open positions and have had all capital fully withdrawn since the October turbulence. This capital-preservation approach protected us from December’s volatility.

As no trades were executed in December, no PBX tokens will be distributed to participants in the Stayking program.

In hindsight, our priority of protecting capital over short-term gains proved effective. December confirmed that sometimes the best trade is no trade. We are currently focusing on preserving our capital, particularly for licensing-related purposes.

Early December wiped USD 1 billion from leveraged trades

The month began with chaos as Bitcoin resumed its decline amid global risk aversion. In the early morning hours of December 1, prices fell sharply across exchanges, leading to the liquidation of nearly USD 1 billion in highly leveraged cryptocurrency bets.

This drop extended Bitcoin’s decline to nearly 30% from early October, when it reached a record high above USD 126,000. Other major tokens were also affected. Ether

fell by 10% to approximately USD 2,700, while less liquid altcoins performed even worse.

The sudden sell-off revealed how fragile market liquidity remains. Order books thinned rapidly under selling pressure, further exacerbating price volatility. Bulls who attempted to “buy the dip” were largely disappointed, as any temporary rebounds proved shallow and short-lived.

By mid-December, the market continued to drift without clear direction, and Bitcoin struggled to reclaim the USD 90,000 level amid weak demand. Trading during the holiday period brought typically low liquidity, meaning even small sell orders could disproportionately impact the market and move prices.

Bitcoin fluctuated between USD 80,000 and USD 90,000 from mid-November onward, without any clear directional trend. Source: tradingview.com

By year-end, Bitcoin was trading at nearly USD 87,000, recording its first annual loss since 2022. This ultimately confirmed the correctness of our defensive stance.

Ethereum’s Fusaka update improves scalability

The fact that market conditions were not ideal did not halt technological and adoption-related progress. Ethereum underwent a significant network upgrade at the beginning of December. The Fusaka hard fork was activated on December 3, 2025, representing an important step in Ethereum’s scaling roadmap.

In practice, Fusaka allows Ethereum to increase the amount of blob data (bulk transaction data) that the network can process. By enabling higher blob capacity without compromising security, this update paves the way for lower fees and greater scalability across Layer 2 networks built on Ethereum.

The Ethereum Foundation described Fusaka as one of the most important technical milestones of the year, building on the Pectra upgrade and strengthening Ethereum’s rollup-focused evolution.

The successful deployment demonstrated that cryptocurrency development has not slowed even amid a market downturn. However, the news had only a limited impact on ETH’s price, as broader market pressure outweighed technological progress. By the end of December, Ethereum was trading just below USD 3,000, representing a significant decline from its annual highs around USD 4,700.

For the Ethereum community and long-term investors, the upgrade served as a reminder that innovation continues and is laying the groundwork for future network growth once market conditions improve.

Ethereum is in a similar position to Bitcoin and has also been trying for some time to find a path back toward growth. Source: tradingview.com

Launch of major altcoin ETF funds: Solana and XRP

While prices stagnated, cryptocurrencies recorded new achievements in traditional finance during December. In particular, two mainstream altcoin ETF funds entered U.S. exchanges, expanding investors’ options for regulated access to cryptocurrencies.

On December 3, Franklin Templeton—an asset manager overseeing USD 1.6 trillion—launched a spot Solana ETF.

The fund holds Solana (SOL) on behalf of investors and also participates in SOL staking to generate staking rewards. By being listed on a major U.S. exchange, it provides institutional and retail investors with a convenient, SEC-regulated vehicle for investing in Solana without directly managing wallets or tokens.

Just one week later, on December 11, 21Shares listed the 21Shares XRP ETF (ticker: TOXR).

This spot XRP ETF allows U.S. investors to gain exposure to XRP, the digital asset used in Ripple’s payment network, through standard brokerage accounts.

The launch of these products was considered a milestone. Solana and XRP became two of the first altcoins, besides Bitcoin and Ether, to have their own ETFs listed in the United States. Their arrival signals growing acceptance of diversified cryptocurrencies on Wall Street. The timing, however, was not ideal. While these new ETFs have opened doors for future investment, a meaningful inflow of capital may have to wait until market conditions improve.

USD 7 million Trust Wallet hack

The cryptocurrency sector was hit by a security scandal in late December when Trust Wallet, a popular software cryptocurrency wallet owned by Binance, revealed a serious breach of its Chrome browser extension.

The incident allowed attackers to steal user assets worth approximately USD 7 million. It occurred around December 26, when users reported that their wallets had been inexplicably emptied during the Christmas holidays.

Trust Wallet confirmed that a malicious update to its Chrome extension (version 2.68) was distributed via an attack that inserted hidden software designed to collect recovery codes.

In practice, once users unlocked the compromised extension, malware silently exported their private keys to the attacker’s server, enabling funds to be drained at will. Within a few days, an estimated 2,500 wallets were compromised.

In response, Trust Wallet urged all extension users to immediately update to the fixed version (v2.69) and promised full compensation to affected users.

This event shook confidence during an already tense period and highlighted that, in addition to price volatility, technical and security risks remain a real threat in the cryptocurrency space.

Realita na konci roku: první záporný rok bitcoinu od roku 2022

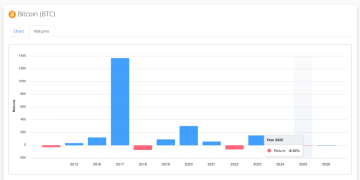

As the final days of 2025 passed, cryptocurrency investors faced a dose of reality. After two strong growth years in 2023 and 2024, Bitcoin ended 2025 in negative territory, recording its first annual loss since 2022.

Source: slickcharts.com

This represented a sharp reversal compared with just a few months earlier. At the beginning of October, Bitcoin climbed to a new all-time high above USD 126,000, driven by ETF optimism and favorable macroeconomic factors. That enthusiasm quickly faded following adverse developments, such as the surprise announcement by the United States of new tariffs in October, which triggered cascading liquidations and a shift in market dynamics.

By year-end, Bitcoin was trading around USD 87,000, representing a decline of more than 6% for the year and over 30% from its peak. Macroeconomic headwinds, such as persistently high interest rates, combined with a waning appetite for risk, had a significant impact on the sector. Although painful for many investors, the resulting market shakeout has likely left the cryptocurrency market in a healthier position at the start of the new year.

Veškeré informace uvedené v tomto článku a jeho obsah nemá sloužit jako investiční poradenství, doporučení či závazný návod k finančnímu rozhodování. Společnost Probinex nenese odpovědnost za jakékoli rozhodnutí učiněné na základě těchto informací. Každý čtenář by si měl před jakýmkoli investičním krokem provést vlastní analýzu a případně konzultovat odborníka.