February on Crypto Markets: DOGE ETFs, Bitcoin Reserves, and the Biggest Hack in History

March 4, 2025

Tomáš Hucík

February 2025 was a big month for crypto. I say this in almost every article that recaps the events, so let’s take a closer look and see if this is just a phrase or if it really holds true.

What about our portfolio?

Bitcoin crashes, market in turmoil

February didn't really add much to our Probinex portfolio. For most of the month, the bitcoin price was around $96,000 per coin, consolidating around this threshold. However, if you look really closely, the local price peaks were progressively lower and lower, while the local lows were progressively deeper.

Well, then came the last week of February, during which the BTC price plunged 18%. One of the biggest market declines ever occurred (considering amount of funds wiped). It was the result of an already too-unclear economic situation in the world (the continuation of the war in Ukraine, the introduction of Tariffs by the US, the ever looming danger of inflation in the US, an overheated technology market,...) combined with a series of disasters directly from the crypto world. Trump coin, Melania coin, Libra, Bybit hack.

The market could no longer withstand such pressure and there was massive de-risking. Investors were therefore selling off their positions. Everybody, not only cryptocurrency holders, but also, for example, stock traders, were derisking.

We were largely positioned outside of the market. When there is a clear sense of uncertainty in the air, where no one knows how the market might behave, it is not a bad strategy to stand on the sidelines and not take any major action. That way you avoid unpleasant surprises. Thus, a large part of our position is currently stablecoins, which we try to supplement with spot positions, but only if the market offers us a suitable situation for buying.

In StayKing, we did not make any profits this month, but we did not take any positions. Thus, we are distributing the 979,957 PBX worth $45,103 that January Earnio contributed to StayKing.

Bitwise is pushing for ETFs on Dogecoin and XRP

Investment firm Bitwise Asset Management has taken significant steps to expand its offering of cryptocurrency investment products. In January, it submitted an application to the U.S. Securities and Exchange Commission (SEC) for approval of an Exchange-Traded Fund (ETF) tied to Dogecoin (DOGE). This move follows similar initiatives by Rex Shares and Osprey Funds, which are also seeking to launch ETFs focused on meme coins.

In February, the SEC officially confirmed that it had received Bitwise’s application for a spot XRP ETF. This development is seen as a major step toward integrating regulated investment products linked to XRP into traditional financial markets. If the SEC approves the proposal, it could mark a crucial breakthrough in how cryptocurrencies are perceived as legitimate investment assets.

These initiatives reflect the growing interest of institutional investors in a broader range of cryptocurrencies and the effort to offer regulated investment products to the general public. If DOGE and XRP ETFs make it to the market, they could significantly impact the volatility and long-term price movements of these assets. There's also talk of ETFs for other cryptocurrencies. Generally, the more a cryptocurrency resembles a commodity, the higher its chances of approval. Here’s a table from leading ETF analysts at Bloomberg. Just a word of caution: just because something gets an ETF doesn’t mean people will want to buy it (looking at you, Ethereum 😊).

Source: X account of Eric Balchunas

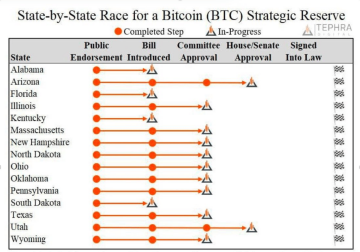

Illinois and Other U.S. States Introduce Strategic Bitcoin Reserves

The state of Illinois has emerged as a pioneer in integrating cryptocurrencies into its fiscal policy. In January, it introduced the "Strategic BTC Reserve Act," proposing the establishment of a state reserve in Bitcoin with a mandatory five-year holding period. The bill suggests diversifying the state's reserves by including Bitcoin to protect finances from inflation and economic instability.

However, Illinois is not the only state embracing Bitcoin as part of its strategic planning. Similar initiatives are underway in Texas, Arizona, and even Wyoming. Texas Governor Greg Abbott has previously stated that he sees Bitcoin as a key component of the state’s economic policy and supports its adoption among businesses and public institutions.

Implementation of the Strategic bitcoin reserve across states in the US. Source: Tephra Digital, LegiScan.

The Collapse of Libra Cryptocurrency

The Libra cryptocurrency, which had even received support from Argentine President Javier Milei, experienced a dramatic collapse. After briefly reaching a market capitalization of $4.56 billion on February 14, it plummeted by over 94% within 11 hours. Analysts have labeled this incident as a large-scale insider scam, with insider wallets linked to the Libra team draining liquidity worth over $107 million.

The event triggered widespread criticism and led to calls for the impeachment of President Milei, who had publicly endorsed the cryptocurrency. What was even more shocking was that the individual responsible for this entire fiasco later went on a media tour, essentially admitting to market manipulation. The whole bizarre spectacle resembled a famous scene from The Big Short, where greedy real estate brokers foolishly boast about their fraudulent schemes..

Graph of Libra’s collapse doesn’t even need a caption.

Source: dexscreener.com

Bybit Exchange Hack: The Biggest Crypto Heist in History

February saw the largest cryptocurrency heist to date, with nearly $1.5 billion stolen from the Bybit exchange. This incident surpassed even the infamous Mt. Gox hack of 2014. Security experts attribute this attack to the North Korean hacker group Lazarus, known for its previous assaults on cryptocurrency platforms.

Bybit confirmed the incident and stated that it is working on strengthening its security protocols. The exchange also assured users that it is actively seeking ways to compensate affected clients. However, this attack once again highlights the crucial issue of security on cryptocurrency exchanges and the importance of storing digital assets outside of centralized platforms.

President Trump Announces Executive Order on Strategic Bitcoin Reserve

President Donald Trump continues his pro-crypto policies and announced on March 2 an executive order establishing a strategic Bitcoin reserve. This move is part of a broader strategy to integrate cryptocurrencies into the national economy and strengthen the U.S. position in digital assets.

According to the executive order, the government would allocate a portion of its reserves to purchase Bitcoin, Solana, XRP, and other digital assets that could play a role in the country’s future economic model. This unprecedented step underscores the increasing role of cryptocurrencies in the global financial system.

However, it’s important to emphasize that just because Donald Trump posts something on social media doesn’t mean it will actually happen. I would be especially cautious when it comes to stockpiling altcoins in anticipation of them possibly becoming part of the U.S. Federal Reserve’s holdings. Including digital gold (Bitcoin), which everyone has heard of and wants, is one thing. Including a cryptocurrency 50 times smaller that "nobody" knows or uses (Cardano) is quite another.

Conclusion: The crypto world never sleeps, and February 2025 was proof of that

For now, it is clear that only Bitcoin is likely to have its position as a fixture of the global economy secured. Other altcoins need to be chosen extremely carefully and these positions approached with caution. While Bitcoin already appears to be a long-term position for several years, other altcoins need to be re-evaluated much more frequently to see if they have a place in the portfolio. After all, how many 2020 coins that were in the 20 to 40 position by market cap are still relevant now?

What’s your take on all this? Are these events truly game-changers or they are just a hype? Share your thoughts on our social media or my X—because real discussions are what crypto needs

From trading charts to DeFi pools, from writing insights to moderating communities—I’m in the crypto game from every angle