August through the eyes of a Quant

September 16, 2022

Martin Carter Smehlik

The summer holidays are over and I can only say that August has been a pretty busy month for us. Let's peek at what the dominant crypto markets actually looked like in terms of market structure.

BTC/USDT price development in August

For more than half of the month, Bitcoin moved within a range between the levels of $23,000 and $25,000. In total, there were 4 attempts to break the 25 thousand mark, but never once successful. Failing to get even closer to the magical area below $27,000 indicated its weakness. The sellers took advantage of this and pushed the market lower to the price of 21 thousand instead. Apparently, due to the expectation of the impending transition to proof-of-stake, Ether recorded a much more convincing bullish course than Bitcoin, and its correction in the second half of the month was noticeably smaller.

The hopeful "long" trend that started in July ended and most markets returned to "bearish" mode. Even before the end of the month of August, Bitcoin again dipped to the level of 19 thousand dollars. Indeed a significant support level considered by many experts as a possible bottom, both short-term and long-term.

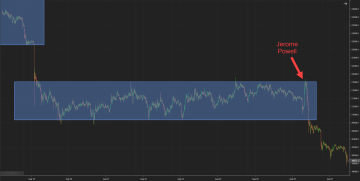

Let's return for a moment to Bitcoin and its behavior in the second half of August. The entire working week was traded in a narrow price range from $21,000 to $22,000. See the image below to get a better idea.

Consolidation of BTC/USDT in a narrow range between August 19-26, 2022

This tight consolidation is very unfavorable for short-term directional trading, as none of the moves have a continuation. The market returns like a magnet to the center of the distribution to the short-term equilibrium price and repeatedly tests its extremes. Even some of our in-house strategies had to be managed thoughtfully given these circumstances.

The consolidation was only broken by FED chairman Jerome Powell, who had a speech in Jackson Hole on Friday 26th at 4 pm.

It is not that common for a planned speech with fairly expected content to cause a stronger market reaction. However, this time was different. The market was very nervous after a week without significant movement and was waiting for any news or action from the outside to get out of this "spasm". In such a context, any news is a catalyst that works like a detonator. It will cause a short-term burst of volatility, during which nearby support/resistance levels are tested and thus accelerate the overall price development. In other words, such an event will force both the bulls and the bears to react and reveal their cards.

At the end of the month, the market showed us that concerns about the development of the global macroeconomic situation are still valid and the way up will be more thorny than originally expected. In September, we are expecting indeed a lot of news, and therefore also potential reasons for market movements in various directions. We expect increased volatility and as well are very curious to see if Bitcoin will break the strong support in the $18,000 to $19,000 zone. No matter the outcome, we shall not be bored.