What is going on with bitcoin?

September 27, 2024

Tomáš Hucík

How is bitcoin doing and what can we expect in the future? That's what we'll look at in today's article.

If you follow economic events, you surely haven’t missed the first cut in US interest rates since Covid.

This reduction results in the cost of borrowing money being lower. This makes borrowing more affordable and gives investors more capital to allocate to riskier assets.

Bitcoin is one of them. Since the FED's approval of a 50 basis point cut in interest rates, the price of bitcoin and other cryptocurrencies is starting to rise.

The cryptocurrency sector has been waiting a long time for a catalyst for short-term growth and this may be it.

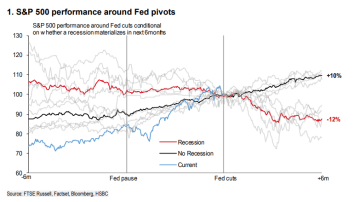

According to an analysis of historical data, if there were rate cuts (of 50 points or more) by the FED and there was no recession at the time, then there was a period of price appreciation in equities and risk assets between the period of 3m and 12m.

But this is contingent on no recession in the US economy. In that case, even rate cuts won't help and a period of worse economic performance follows. At the moment, the possibility of a recession is still there, but according to participants of Polymarket prediction market, it looks more like a soft landing.

Source: FTSE Russell, Factset, Bloomberg, HSBC

Traders are aware of this seasonality, or if you prefer the effect of rate cuts, and so they are already trying to get ahead of this phenomenon and are buying assets.

Thus, the interest rate cut may have a short-term impact on the rising bitcoin price before the rise in asset prices shows up in the rest of the economy.

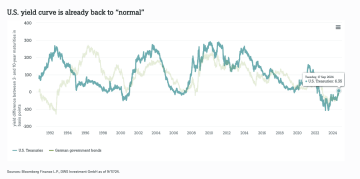

When you add to that the fact that the US Treasury yield curve is inverting after a long time, things start to get interesting. The yield curve shows what the yields are on US Treasuries depending on their maturity. Typically, under normal market conditions, it works out that the longer-term bonds with later maturity dates, the more interest there is on them. That's because the longer you lend money for, the more uncertainty you are undergoing about what will happen in the future. You are taking a risk because you don't know what might happen 7 years from now.

But for the last few years, short-term bonds have had higher yields. Investors have been more uncertain about what will happen in 2 years than what will happen in 10 years. The nervousness in the market was palpable. An inverted inversion curve typically occurs when the economy is not doing well, and investors do not know what will happen in the coming months. Not wanting to borrow money in the short term, they stock up on cash. Well, that curve has come back again. At least for now. Investors are regaining their courage and conviction, in soft landing, that the crisis will pass us by.

So the short-term bull case is relatively nice to see.

But one of the events that lies ahead is the US presidential election.

In that, Donald Trump and Kamala Harris are facing each other.

This event is a big unknown for the time being and, in particular, a potential victory for Kamala Harris, who is currently narrowly leading in the polls, could mean a sell-off in the medium term. After all, her opponent is Donald Trump, who is clearly trying to position himself as a pro-crypto candidate. He is launching his own cryptocurrency project, paying with the lighting network and mentioning that the US would never sell any of its bitcoins.

If you're so strongly on the side of cryptocurrency technology, in the event of your opponent winning, that could be bad for bitcoin, right?

Except that it's not that simple either. Because Kamala Harris also recognizes that bitcoiners are very much a "single issue voter," that is, voters who make their decision based on a single issue. And she doesn't want to lose them.

Granted, her rating in relation to cryptocurrencies was recently downgraded to "NA", which basically means she hasn't taken a stance on the issue at all, but that's not quite true.

Because just a few days ago, she let it be known that she:

"(We) will encourage innovative technologies like AI and digital assets while protecting consumers and investors. “

As they say, a politician promises a lot before an election. Much better, perhaps, is to "follow the money trail". Well, cryptocurrency companies are contributing generously to both Republicans and Democrats. Campaign staff for Kamala Harris are also meeting with representatives from companies like Ripple or Coinbase, so the fear that Kamala Harris and her party would want to destroy crypto is probably more paranoid than based on truth. Thus, in the short period of time, her victory may mean a drop in prices across the crypto world, and especially around election night, prices may be extremely volatile.

In the the long term though, things are happening the way we're really not used to. You can think what you want about bitcoin, but when even BlackRock refers to it as " the rescue from the collapse of the economy", it means something. BlackRock is the largest asset management company in the world. They control assets of more than 10 trilion dollars and just a few days ago they released a report called Bitcoin: a Unique Diversifier. In it, they describe why bitcoin is so attractive to investors in terms of its disconnect with traditional finance given its unique characteristics.

These, according to BlackRock, are:

- The limited amount of bitcoin, which means its value and supply cannot simply be diluted.

- Its global, digital nature, which allows it to be moved from one side of the world to the other with minimal cost and time

- Decentralized structure. Thus, the movement of bitcoin is not controlled by anyone and cannot be prevented. There is no point of authority that controls it and thus it is literally an open monetary, or if you like, value system.

Bitcoin is also an uncorrelated asset according to BlackRock. Its price does not replicate other assets and because of that it complements the other components of the portfolio so well. While bitcoin is still a risky asset, it has built a category of its own in the risky asset category due to the aforementioned characteristics.

"And that's why bitcoin held in modest allocations can have a diversifying effect on a portfolio".

But the question is why bitcoin is attracting an increasing number of investors. According to BlackRock, "Growing concerns in the U.S. and abroad about the state of the U.S. federal deficit and debt have increased the attractiveness of potential alternative reserve assets as a possible hedge against possible future events affecting the U.S. dollar."

Could it be that cryptocurrency investors around the world are right?

Arthur Hayes, CEO of the Maelstrom Fund says in his latest essay:

"Like holding an inflated ball underwater, the deeper you push the ball, the more energy it takes to maintain its position. The deformations are so extreme on a global scale, especially for Pax Americana, that the amount of printed money needed to maintain the status quo grows exponentially every year. Therefore, I can say with confidence that the amount of money printed from now until the eventual reset of the system will dwarf the total amount that has been printed from 1971 to the present. It's just math and physics."

If you too have been thinking about how to diversify your portfolio and expose it to cryptomarkets but have not yet found a suitable solution, please do not hesitate to contact us. We will be happy to help you.

The information provided in this article is for general informational purposes only and should not be construed as financial or investment advice. The content does not constitute an offer, recommendation, or solicitation to buy, sell, or hold any financial instruments, assets or cryptocurrency. Always seek the advice of a qualified financial professional before making any investment decisions. The author and publisher are not responsible for any financial losses or decisions made based on the information presented in this article.