Looking Back at Earnio: Two Years of Proven Growth

December 2, 2024

Earnio has nearly two years of proven history and results, positioning us among the leading players in modern investments. During this period, we achieved record growth in assets under management (AUM), distributed over one and a half million USDC, and demonstrated that the combination of transparency and innovation can deliver excellent results..

In January 2023, we launched our flagship product—the investment platform Earnio. In less than two years, we have achieved numerous milestones and built a solid track record that is regularly reviewed by the globally renowned firm Grant Thornton, which evaluates our trading activities, results, and cryptocurrency wallet balances every month.

In August 2023, we launched Earnio Fix, focused on fixed returns, and managed to fully subscribe it within just 13 months—without relying on marketing campaigns. Most clients discovered Earnio through recommendations from satisfied customers.

This reflects the trust of investors who supported us despite the dynamic market environment. The growth in AUM, the number of active clients, and their participation in the StayKing program clearly demonstrate that our vision is delivering results.

How has Earnio evolved? What are its achievements? How has the capital we manage grown, and what lies ahead? You'll find all this and more in this article.

Earnio in numbers:

Growth in AUM and the number of active clients

The year 2024 was a milestone for Earnio:

Assets Under Management (AUM): We surpassed $12 million USDC, with $10 million USDC allocated to Earnio Fix.

Active Accounts: Earnio is utilized by 1,266 clients who benefit from the combination of fixed and dynamic returns.

The $10 million USDC limit for Earnio Fix was reached in a record 13 months, reflecting its appeal and stability.

Earnio Results:

Long-term Performance and Transparency

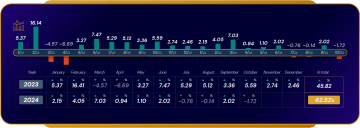

The year 2023 was a period of significant growth for Earnio, with monthly returns ranging from 16.14% (February) to -6.69% (April), resulting in an overall annual return of 45.82%. Despite occasional declines, the strategies achieved strong annual appreciation thanks to robust capital management.

In 2024, Earnio maintained stable returns despite the challenges faced by the markets.

Key moments include:

March 2024: The highest monthly return of the year reached 7.03%.

October 2024: The lowest value of the year stood at -1.72%.

The average monthly performance in 2024 reflects the ongoing stability of our strategy.

Overall Performance

The long-term performance of our strategies since the beginning of measurement exceeds 62%, confirming their robustness and ability to generate attractive returns for our clients.

Over its two-year existence, Earnio has distributed a total of 1,508,848 USDC to its users.

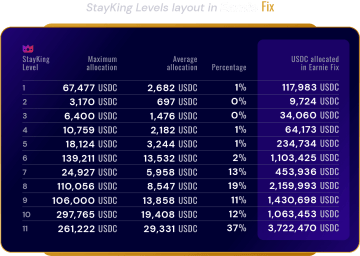

StayKing at a High Level:

The vast majority of clients hold StayKing

at an advanced level.

The majority of our clients, specifically 93%, have chosen to participate in the StayKing program. This result highlights that the utility of PBX is widely embraced and effectively fulfills its purpose. Additionally, most clients hold a StayKing Level higher than 7, enabling them to achieve greater returns.

What’s Ahead:

Earnio Horizon and an Enhanced Dynamic

Building on the experiences and feedback from our clients, we are taking Earnio to the next level.

Earnio Horizon 3y

In 2025, we are launching a new product, Earnio Horizon 3y, which replaces the Fix program. This new offering will continue to provide fixed returns but with improved conditions for greater stability and deposit protection for clients. Investments in Horizon will span three years, with returns paid out annually.

Earnio Dynamic improvements

With the arrival of the CASP license, we are fully committed to elevating the Dynamic variant, which will receive a significant upgrade. The share of trading results will now range from 50% to 70%, depending on the StayKing Level achieved by clients.

Summary:

Track Record and Future Vision

In nearly two years of existence, Earnio has exceeded expectations. The growth in assets under management, the rapid success of the Fix program, and the high level of client engagement in StayKing confirm that we are on the right track.

With new product variants like Earnio Horizon 3y and the enhanced Dynamic, we aim to provide our clients with even more opportunities to grow their investments effectively. These products are designed to remain competitive as we expand into international markets, aligned with emerging regulations and the CASP license. We look forward to their rollout across Europe.

Thank you for your trust, and we look forward to reaching new milestones together!