10 predictions for cryptocurrencies in 2025: the future of bitcoin and other coins

January 10, 2025

Tomáš Hucík

If 2024 was a watershed year for cryptocurrencies, 2025 will show the true potential of the industry. Therefore, I have decided to put together 10 predictions of what I think will happen in cryptocurrencies.

Please don't take any of this as investment advice, no one really knows the future. But if I guess any of these right, you can be 100% sure I'll be saying “I knew it!”

1. The US will adopt bitcoin as a strategic reserve

Donald Trump's victory and his openly pro-crypto stance opens the door for growth across the entire cryptocurrency spectrum. Moreover, a large portion of his executive branch is also very pro-crypto including, for example, Vice President J.D. Vance, National Security Advisor Michael Waltz, Commerce Secretary Howard Lutnick, Treasury Secretary Scott Bessent, Securities and Exchange Commission (SEC) Chairman Paul Atkins, and others.

My guess is that the US will declare bitcoin a strategic reserve and commit not to sell any of the bitcoins it has acquired so far. (Unless the outgoing Biden administration sells them sooner)

But I don't think the US, as the federal government, will buy new bitcoins from the market for this reserve. (If so, I'll evaluate this prediction as partially correct)

On the other hand, I do think that some of the individual US states will buy bitcoin, as some sort of hedge against possible inflation.

2. Other central banks will try to acquire bitcoin

As the United States open up to bitcoin adoption, central banks around the world will face increasing pressure to respond. At a time when bitcoin is increasingly seen as digital gold and a hedge against the devaluation of fiat currencies, rival states will look to quickly reduce their reliance on the US dollar. Thus, this shift will not only be a financial strategy, but also a geopolitical strategy. This level of adoption is likely to trigger the price reflexivity effect - a self-reinforcing cycle where rising demand increases value, further motivating new buyers.

Countries that have a history of antagonism towards the dollar are likely to be among the first to reach for bitcoin. Should they be big players like India or Russia, this bitcoin race could rocket off. But I expect that officially it will be more likely to be smaller countries.

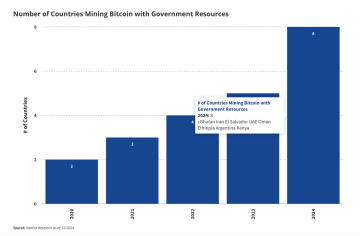

There are already 8 countries mining bitcoin de-facto officially. Others will follow in the quest to acquire bitcoin, either by mining or buying.

Source: VanEck Research. 8 countries were mining bitcoin in 2024. Bhutan, Iran, El Salvador, the United Arab Emirates, Oman, Ethiopia, Argentina and Kenya.

3. At least one of the FAANG companies will buy bitcoin

FAANG is an acronym referring to the five largest and most influential technology companies in the US. They include Facebook (now Meta), Amazon, Apple, Netflix, Google (now Alphabet) These companies are known for their dominance in the technology sector and have a significant impact on the global economy, innovation and financial markets

It may be a bold prediction, but I think we'll see bitcoin on the books of at least one of them by 2025. These companies hold huge amounts of liquid cash. Even just a few percent in bitcoin could mean billions of dollars in purchases.

I consider bitcoin's inclusion on the balance sheets of Nasdaq 100 companies such a certainty that I won’t even list it as a prediction.

4. Big banks will launch their own stablecoins

Big banks (read e.g. JPMorgan, Citi, or something similar) will create their own stablecoins to integrate seamlessly into the cryptocurrency ecosystem. These coins will not only facilitate faster settlement of transactions, but also offer attractive yields associated with government bonds.

It's actually not that complicated. Paypal has already launched its own stablecoin. VISA has launched a platform to easily launch stablecoins for other banks. Spanish bank BBVA is going to launch its own stablecoin in 2025.

Many banks are already experimenting with their own public ledger solutions, they don't want to be left behind. After all, why should they, one of the biggest success stories in the crypto world was achieved by stablecoin issuer Tether.

This project generates astronomical returns with only a few dozen employees. And that simply has to be interesting for any bank and now, with the advent of pro-crypto leaning executive and legislation in the US, they finally have the door open in the banking sector.

5. The total supply of stablecoins will grow by more than 50% and exceed $300 billion by 2025

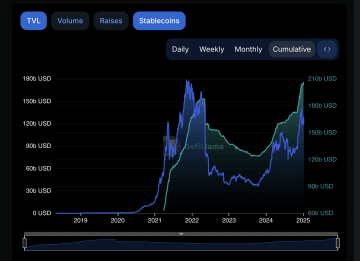

I was originally going to guess a higher number, but this seems more in line with reality. The current supply is something like 200 billion. However, given the previous prediction, the gate is open for new stablecoins. Whether the stablecoins are in the hands of fellow high-tech companies, big banks, or innovative projects from the crypto world, there is nothing stopping the growth of stablecoins. Stablecoins will play an important role in international trade, remittances and interbank transactions.

The only thing they have to watch out for are the various regulatory requirements, as it is the issuance of stablecoins that is regulated by, for example, the European MiCA regulation.

6. The total value of cryptocurrencies locked in DeFi will exceed $200 billion in the long term

Despite record high trading volumes on decentralized exchanges, both in absolute numbers and relative to centralized exchanges, the total value locked in decentralized finance (DeFi) applications remains roughly 25% below its peak. I expect decentralized trading volumes to grow, driven by the boom in AI-related tokens and the growth of new user-friendly decentralized applications.

The influx of tokenized securities, higher stablecoin supply (see previous point) and a friendly regulatory environment will, in my view, support DeFi's growth. Therefore, I believe that DeFi TVL (Total Value Locked) will grow to over $200 billion by the end of the year, reflecting the growing demand for decentralized solutions.

Source: defillama.com In the chart, you can see the stablecoin stock in green and on the right axis, and the value of cryptocurrencies locked in DeFi apps in blue and on the left axis.

7. On-chain activity of AI agents exceeds 1 million agents

One of the most interesting trends that I believe will gain huge popularity in 2025 is AI agents. However, this industry is very young and a bit complicated to evaluate. Currently, these are specialized bots that help achieve specific goals, such as market analysis or increasing engagement on social media.

AI agents can self-adapt and often focus explicitly on one area. Tools like Virtuals then allow even ordinary users, without technical knowledge, to create their own AI agents. This creates a huge number of agents that their creators can rent out and monetize.

Although AI agents today are mainly focused on DeFi, their use is growing rapidly. They are already acting as influencers on social media, players in games or interactive assistants. I think there will be over a million new AI agents by 2025, unless there is a clampdown from platforms like X (formerly Twitter).

8. Gamers won't succeed

This point is a bit of a cheat. I decided to copy it word for word from the 2024 prediction because I stand by that prediction EVEN in 2025, and even though I'll be testing a new blockchain-based game right here in the Czech Republic this weekend.

“This is one of my more controversial predictions. However, I don't expect a massively popular blockchain-based game in 2024, despite market sentiment. Although we also hold tokens focused on gaming, i.e. computer games, in our Probinex portfolio, I am skeptical in this area. Of course, I will be very happy if GameFi does well, but I still can't explain why computer games need crypto.

I spent hundreds of hours as a teenager playing Dota, Magic the Gathering or CS. Not once while playing them did I think "ooo, how cool would it be if this game ran decentralized and unrestricted on a public ledger".

My thoughts were more like "oh how cool would it be if this game was more fun, faster, more interesting". And I don't see how blockchain will bring that about. Here I kind of feel like Gaming and Crypto are being lumped together simply because both were originally a hobby of similar types of people. But I'm happy to be misled.”

9. Cryptocurrencies or digital assets will be on the election agendas of at least four Czech political parties

After Donald Trump's victory in the US presidential election, the leaders of the Czech political scene will not want to risk abandoning bitcoin and leaving activity in this area to the competition.

It is already evident from the activities of Andrej Babiš, former prime minister that is eager to win this year. For example, he likes the US president's plan to win over this section of the electorate. Other parties will probably not want to be left behind, especially if we consider that the Pirates, for example, have also built their brand on their digital identity from the start.

10. Earnio will have an AUM at least three times higher

The last prediction also kind of copies the one from last year. It's almost impossible to continuously multiply our AUM, but I still dare to guess that we will reach at least 36 million USDC in Earnio.

Moreover, I am making this prediction on purpose without consulting the sales department. We have two years of trading history with independently verified results. We are applying for licenses in both Europe and the Middle East and with the arrival of MiCA regulation to Europe, the interest in regulated and quality cryptocurrency startups will only grow.

Investing in cryptocurrencies comes with a high level of risk. The value of cryptocurrencies can fluctuate rapidly, which can lead to significant gains as well as losses. Before investing in cryptocurrencies, always study the market thoroughly, consider your financial options and consult an expert. Historical performance is no guarantee of future results.

Nothing in this article constitutes an investment recommendation, financial advice or an offer or solicitation to buy or sell any financial instrument. All information contained herein is for educational and informational purposes only.

Probinex shall not be liable for any losses caused by investment decisions made on the basis of our information. Only invest funds that you can afford to lose.