Trading Commentary: Professional Trader Summarizes the Market in June 2022. What's ahead of us?

July 18, 2022

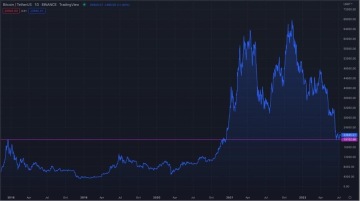

June just ended the second quarter of the year, and unlike diligent students - cryptocurrencies are getting a bad report card for their performance. Bitcoin fell by almost 45% in June alone and overall lost 75% since last year's all-time high. BTC eventually experienced support both times the price dropped to $19,000.

Chart of the development of the closing prices of BTC/USDT, the purple line indicates the support at the price of 19 thousand dollars

In the stock markets, which have recently been highly correlated with cryptocurrencies (both influenced by the same macroeconomic events), we can see a 24% drop in the S&P 500 index. According to CNBC, such a drop in the index of more than 20% is an indicator of a bear market. Looking back in history to the year 2008, comparably large drops have already occurred three times, and the S&P 500 market was always able to recover from them fairly quickly and continue the "bull run" again. Can the stock market make it for the fourth time?

Let's get back to cryptocurrencies. From the perspective of a technical trader, we are still experiencing a downtrend. However, "long" positions are starting to become more attractive, especially when considering the risk-to-reward ratio. Enormous pessimism and fear in the market usually result in many market participants betting "short".

The summer holidays just began and after a long hiatus as well the first "covid-free" holidays. Activity can be expected to be reduced and liquidity lower. Cryptocurrencies have recently lost a significant part of their market capitalization, moving the market is easier today than it was at the beginning of the year.

I would not be surprised at all if the whales took advantage of this situation at the right moment and tried a so-called "short-squeeze". This is a very risky strategy in which you take advantage of the fact that too many traders are betting through short positions on the price to fall. In this case, a small fluctuation can mean an increase in the asset by tens of percent. All it would take is an impulse in the form of some positive market news.

There is indeed still a lot of uncertainty in the market on all fronts. There are many development scenarios and the specific probabilities are unknown to us. That is why we are cautious and trade only in situations that we can define in all their variability and that we know do offer a statistical advantage.