Join us as we take a look at what happened in the cryptocurrency markets in April 2024

May 7, 2024

Tomáš Hucík

In this article, you will read about events in the world of cryptocurrencies. In today's text, for example, you will learn about the sentencing of the CEO of the cryptocurrency exchange FTX, the approval of the first ETF funds in Hong Kong or the long-awaited bitcoin halving.

Sentencing of the former CEO of cryptocurrency exchange FTX

At the beginning of the month, fans of justice and retribution were pleased to hear that Sam Bankman-Fried, the founder and former CEO of the cryptocurrency exchange FTX, was sentenced to 25 years in prison. He was found guilty of seven different fraud and conspiracy offenses.

FTX was once valued at $32 billion but collapsed after it was revealed that more than $8 billion of customer funds were misappropriated.

These funds were used for various investments, real estate purchases, and political contributions. This story is now drawing to a close, but it may still take some time before, and if at all, defrauded investors recover all their funds.

Approval of the first ETFs in Hong Kong

This month, regulators in Hong Kong approved the first exchange-traded funds (ETFs) for Bitcoin (BTC) and Ethereum (ETH), aiming to position Hong Kong as a major Asian hub for cryptocurrency trading. In competition with other countries and cities such as Dubai (where Michal Baturko Olbert is also active), it will not be easy.

These ETFs are expected to attract both large and individual investors by offering a more regulated and potentially less risky investment option.

However, some experts are unsure if these products will be as successful as similar ones in the U.S., noting that previous cryptocurrency ETFs launched in Hong Kong in 2022 attracted less interest than their U.S. counterparts.

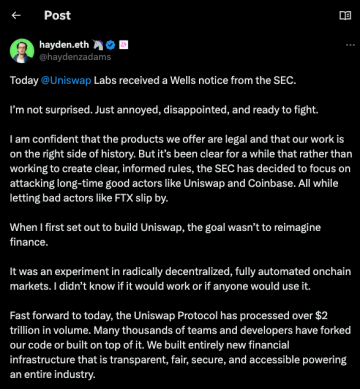

Uniswap Labs sued by SEC

Uniswap Labs, which operates a decentralized cryptocurrency exchange, is being sued by the U.S. Securities and Exchange Commission (SEC). The SEC actively regulates cryptocurrency exchanges and treats digital assets similarly to traditional ones.

Uniswap claims to operate in compliance with U.S. regulations and plans to contest any SEC actions. The specific reasons for the SEC's planned lawsuit have not been disclosed.

I believe that Uniswap plays a vital role in the cryptocurrency ecosystem. It provides market and liquidity access to projects and users worldwide. Under the guise of user protection, the SEC is trying to limit their services. In my opinion, this significantly hinders progress in cryptocurrency sovereignty.

Escalation of the conflict between Iran and Israel

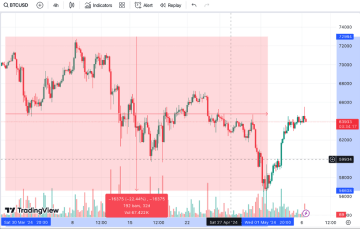

After a drone and missile attack by Iran on Israel in retaliation for a previous Israeli attack, there is heightened fear of a broader conflict in the Middle East. This uncertainty caused immediate drops in cryptocurrency prices over the weekend, with Bitcoin falling from $67,800 to $61,300..

Other major cryptocurrencies also experienced sharp declines, and the market saw significant sell-offs, particularly among more speculative cryptocurrencies.

The impact of halving on Bitcoin supply and demand

Bitcoin, the largest cryptocurrency, recently underwent a "Halving," which occurs approximately every four years and is a technical adjustment that reduces the rate at which new bitcoins are created. This halving cuts the rewards that bitcoin miners receive for creating new tokens, thus slowing down their supply to the market.

Following the halving, Bitcoin's price remained relatively stable, showing only a minor decline. Market participants and analysts consider this event to be long-term positive in terms of its impact on the price (reducing the influx of new bitcoins).

From my perspective as a trader, this is a long-term positive regarding the price. However, from a short-term perspective, it essentially acted as a "SELL THE NEWS" event, meaning it was an event everyone knew about and therefore did not have such a positive impact.

Various macroeconomic events caused the price of Bitcoin to fluctuate from $71,000 to $56,000. In cases of similar macroeconomically driven volatility, it's important to stick to your plan and not give in to unnecessary emotions

if you look at the Bitcoin chart for April, you'll notice that it was indeed a highly volatile month.

Our portfolio

"Damn, we're going down, I must sell!" or "We're pumping up, max long!" are the worst things you can do in an uncertain situation. It's important to be realistic and, if your thesis is not being fulfilled and is invalidated, do not hesitate to close the position, or even better, have an exit strategy set when you open the trade. (Both taking profits and setting a stop loss in case the trade goes south.)

Most of April, we thus stood "aside" and observed how the market situation unfolded and waited for a potential opportunity. That came at the end of the month. I'll reveal a bit about the situation at the beginning of May to participants of StayKing.

The last days of April were very interesting and at the lower price range, or values between 61 - 59 thousand USDT for BTC, we bought into derivative futures positions.

However, these positions had a very tightly set stop loss order, which was quickly filled during the drop at the end of the month. Against that, however, we partially closed our spot positions (real bitcoin, not derivatives) at a profit.

Going into May, we thus have smaller profitable positions open on the spot for BTC and ETH. The DEFI and altcoin part of the portfolio experienced a significant drop, which we used for accumulation. In short, the profits from spot positions covered the losses from the futures and DEFI portfolio accumulated.

We are currently closely monitoring the market situation, and if weakness is shown in the market, we are prepared to close positions. The current portfolio allocation is stablecoins 60%, futures part 20%, spot BTC and ETH 5%, and DEFI portfolio 15%.

This month, 327,443 PBX will be distributed among clients, all produced by Earnio in March 2024, achieving a great appreciation of 7.03%. This confirms that with the growing AUM in Earnio and strong results, Earnio could potentially become a major long-term contributor to StayKing rewards. The average yield for StayKing is 0.064%.

If you have any questions, don't hesitate to ask us.