July in the crypto world marked by the impact of the attack on Trump

August 5, 2024

Tomáš Hucík

In July 2024, many foreign social commentators or moderators said that if this were a TV show scenario, it would be a completely crazy episode.

In the world of cryptocurrencies, it was no different.

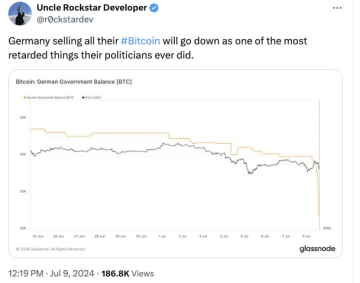

The market's direction at the beginning of the month was set by two events, both causing selling pressure. One of them was the sale of bitcoins by German authorities. The German authorities were selling a large number of bitcoins obtained during their criminal proceedings into the market. The German authorities sold up to 50,000 bitcoins this way. Some influencers even called it a stupid move by the German government.

The truth, however, is that the authorities had no other option. According to German regulations, all seized items must be sold, so Germany was forced to sell about 50k BTC into the market.

The panic caused by this sale was further magnified by the fact that the defunct bankrupt bitcoin exchange Mt. Gox began distributing assets stolen from clients during a hacking attack in 2014.

Repayment increases selling pressure on the bitcoin (BTC) market because a large amount of BTC that was not there before suddenly gets distributed into the market. Whether the bitcoins were sold by the actual Mt. Gox clients or just other market participants who feared these sales, this also contributed to the gradual decline in price.

Hackers stole the meme coin Shiba Inu worth 100 million dollars from WazzirX

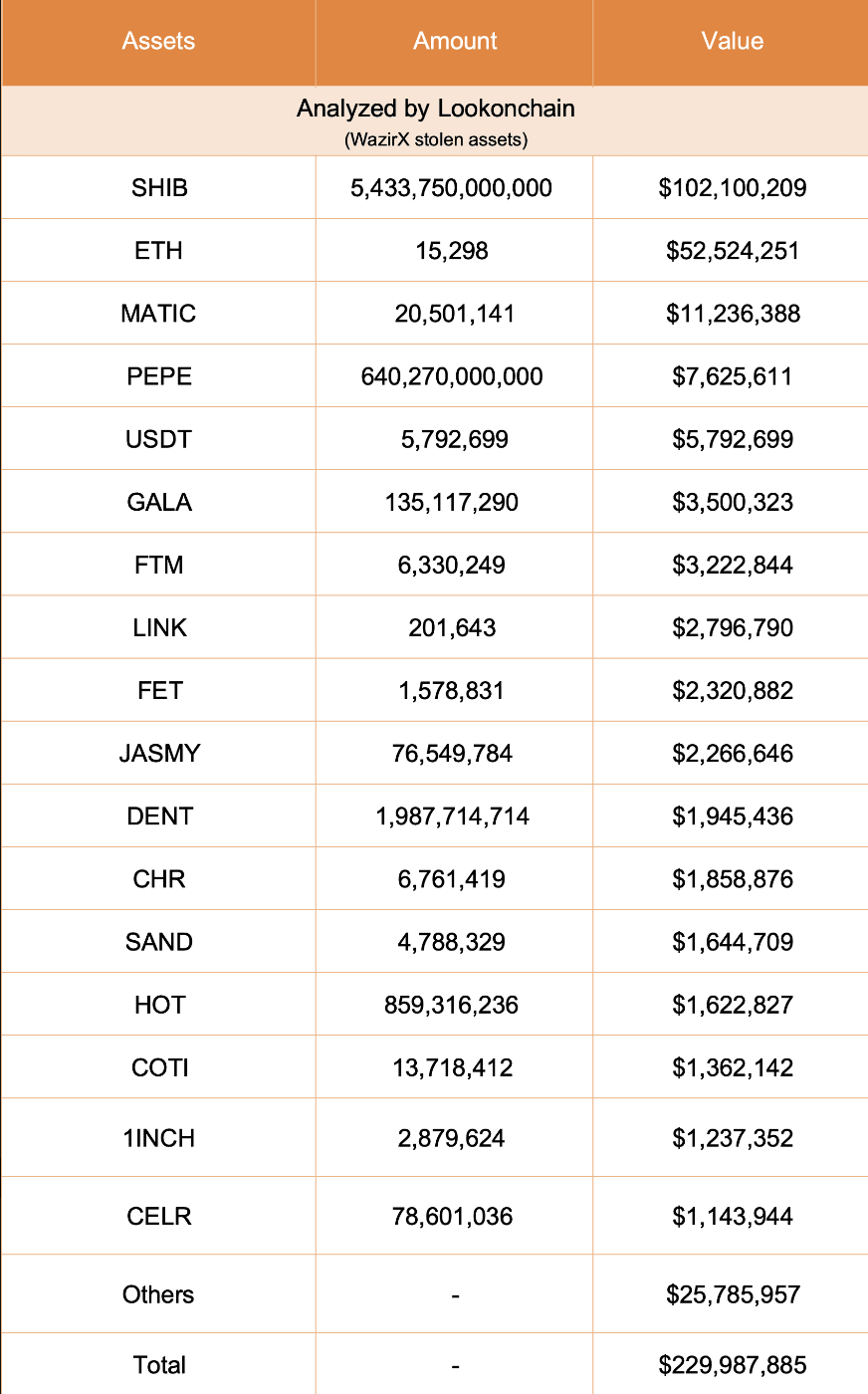

And to add to the bad news, around mid-month an Indian exchange WazirX was hacked. The course of the hack could even be tracked in real-time on the blockchain.

The attacker probably managed to somehow hack one of the reserve wallets of this exchange and send crypto worth approximately 230 million dollars from there to their wallets. They managed to steal a large number of various cryptocurrencies, including ether, Matic, Pepe, and other tokens.

The most affected was the meme coin Shiba Inu; the attacker managed to steal these tokens worth up to 100 million dollars. The stolen cryptocurrencies were then sold into the market on the decentralized exchange Uniswap. The price of the cryptocurrency SHIB started to fall in response to this hack, at one point by -12%.

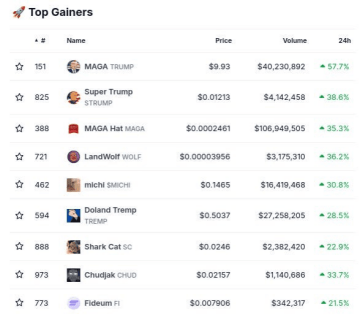

Over 1,000 meme coins created after Trump assassination attempt

The biggest event of this month, however, was certainly the assassination attempt on Donald Trump. Whether you are a fan of this controversial candidate or not, it must be said that this historic moment will definitely have significant consequences for the whole world, including the crypto world.

Interestingly, the platform for the simple launch of any meme coin, pump.fun, reports that even before US President Joe Biden managed to comment on the shooting, more than 1000 Trump-themed meme tokens had already been created on this platform.

1000+ trump-related pump funs launched before biden made a statement

— pump.fun (@pumpdotfun) July 13, 2024

let that sink in

This actually shows how fast the crypto world is and how incredibly quickly it reacts to historical events.

Tokens with this theme were also the most searched for and saw the biggest price growth.

Some users of Twitter or Telegram claimed that they actually realized that the assassination had happened because of this.

By the way, do you know the Polymarket app? It is the largest prediction market where you can place bets on anything online. And according to the bettors on Polymarket, the probability that Trump would win the election rose to more than 65% immediately after the assassination attempt.

And because Donald Trump positions himself as a pro-crypto-oriented candidate, and he just survived an assassination attempt, the sentiment in the crypto market also changed.

Trump and his promises at the Bitcoin conference

Already the day after the assassination attempt, the Fear and Greed Index, which shows how much traders are afraid vs. how much they are greedy, got into positive numbers, meaning greed began to prevail. Just two days earlier, we were at low numbers and concerns dominated the market. That’s why this historic moment can be so important.

A few days after the assassination attempt, Donald Trump also attended the annual Bitcoin conference in Nashville. In his speech, which he delivered in front of the audience at this conference, he promised a lot.

I will mention, for instance, that as president, he would immediately fire Gary Gensler, the head of the US Securities and Exchange Commission, or that he would like the US to be a number one in bitcoin, both technologically and in mining. He even wants the US to create strategic bitcoin reserves.

It is important to realize, however, that Donald Trump is primarily a presidential candidate who is chasing votes and sponsors. How many of his promises he will actually be able and willing to fulfill is an entirely different topic.

This is also evident in the graph. Right after his speech, BTC rose to as much as $70,000, but the enthusiasm slowly cooled and by the end of July, it was trading back around $65,000.

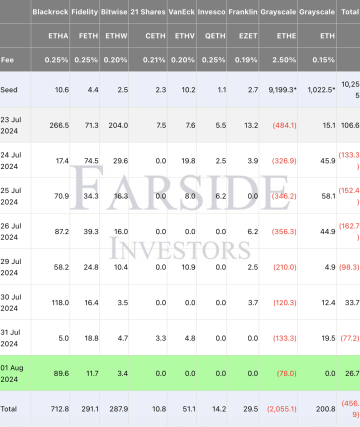

Trading of Ethereum ETFs has begun

But enough about politics, another extremely important event occurred in July. On Tuesday, long-awaited trading in spot Ethereum ETFs began. ETFs work in such a way that funds buy the “underlying asset,” against which they then issue shares. These fund shares can then be traded on exchanges by traders.

The long wait is over, and the second largest cryptocurrency is now also available for institutions operating in a regulated standard environment.

However, it seems that those who say that the initial period will not be a walk in the park are right about the price development.

Ethereum is about 3x smaller in terms of market capitalization compared to Bitcoin. It is also much less known in the world. The interest in these spot ETFs is thus much lower, and moreover, the company Grayscale set the price of fees on its ETF at 2.5%, which is very high compared to the competition.

Because Grayscale previously had a trust that held a large amount of ether and now transformed and opened in the form of an ETF, large sales are expected from them at the beginning because clients will not want to accept these fees. (A similar situation occurred with bitcoin.) The first week of the operation of this ETF indeed looks like sales are creating significant pressure, as we have only seen two positive days by 1.8. The price of ether responded as you would expect and is slowly declining.

How did our portfolio perform?

We took a break from trading with our portfolio for a while. In a very volatile and unclear period, we, as they say, “sat on the bench” and mostly just watched the price development. We did not actively engage in trading futures and spots.

However, we took advantage of the price drops to accumulate in case the market decided to go up for a longer period. We bought ether and Solana relatively low (I mean within the range where we are currently moving). Our pending purchase orders for bitcoin were not hit in the declines. The altcoin portfolio, which is currently set to use 20% of capital, is already 75% filled. The portfolio currently holds about 25% in cryptocurrencies, and the rest are stablecoins.

This month, we are distributing 63,292 PBX, valued at $8,263, to our clients. After distributing rewards to clients last month, Earnio did not make any contributions to StayKing.